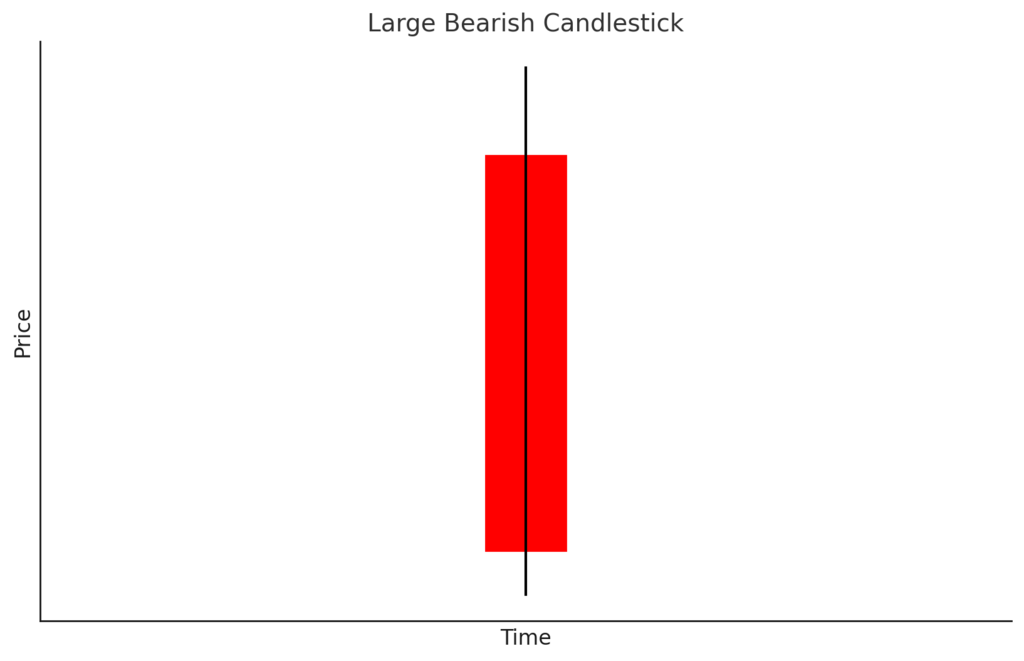

This blog provides a detailed explanation of the “Large Bearish Candlestick” (or “Large Down Candle“), a crucial component of technical analysis. It’s packed with useful information for trading, including the basic concept of this candlestick pattern, its variations, trends based on its appearance, and how to combine it with other indicators. By mastering the knowledge of the large bearish candlestick—essential for interpreting candlestick charts—you can sharpen your ability to accurately gauge market movements.

- 1 1. Misingi ya Mishale Mikubwa ya Upinzani

- 2 2. Aina za Mishale Mikubwa ya Upinzani

- 3 3. Large Bearish Candlestick Appearance and Trends

- 4 4. Combining the Large Bearish Candlestick with Other Technical Indicators

- 5 5. Trading Strategies Based on the Large Bearish Candlestick

- 6 Muhtasari

- 7 Maswali Yanayoulizwa Mara kwa Mara

1. Misingi ya Mishale Mikubwa ya Upinzani

Mishale Mikubwa ya Upinzani ni Nini?

Mshale mkubwa wa upinzani ni moja ya ishara muhimu zaidi za upinzani kwenye mchoro wa mishale. Muundo huu una sifa ya mwili mrefu, ambapo bei ya kufunga iko chini sana kuliko bei ya kufungua. Inaashiria shinikizo kubwa la uuzaji na inaonyesha uwezekano mkubwa wa kushuka zaidi kwa bei.

Jinsi Mishale Mikubwa ya Upinzani Inavyoundwa

Masharti yafuatayo ni muhimu ili mshale mkubwa wa upinzani uunde:

- Mwili Mkubwa : Mwili wa mshale unaonekana mkubwa zaidi ikilinganishwa na mishale iliyopita.

- Kivuli Chini kifupi : Kivuli chini kinapaswa kuwa kifupi iwezekanavyo, au bora zaidi, kisipo.

Mshale mkubwa wa upinzani unaokidhi masharti haya unaashiria nguvu ya harakati za uuzaji na unaweza kuwa alama ya mabadiliko katika mwenendo.

Saikolojia Inayomzunguka Mishale Mikubwa ya Upinzani

Mshale mkubwa wa upinzani hauonyesha tu kwamba bei imepungua; pia unaakisi saikolojia ya washiriki wa soko. Hasa, mambo yafuatayo ya kisaikolojia huwa yanahusika:

- Hofu : Wawekezaji wanaouza nafasi zao wanaweza kusababisha athari ya mpira wa theluji, ikisababisha kushuka zaidi kwa bei.

- Shinikizo la Uuzaji : Muonekano wa mshale mkubwa wa upinzani unaweza kusababisha kuchukua faida au maagizo ya stop‑loss, na kuunda shinikizo kubwa la uuzaji.

Umuhimu wa Mishale Mikubwa ya Upinzani

Mshale mkubwa wa upinzani ni muundo wa mishale wenye thamani kubwa unaoonyesha nguvu ya mwenendo au uwezekano wa mgeukuko. Unapoonekana katika mwenendo wa kushuka, mara nyingi huongeza uwezekano wa kushuka zaidi na hutumika sana kama rejea kwa maamuzi ya biashara. Uaminifu wake unaongezeka zaidi ukichanganywa na muundo mwingine wa michoro na viashiria vya kiufundi.

Muhtasari

Mshale mkubwa wa upinzani una jukumu muhimu katika maamuzi ya uwekezaji. Ukiwa na mwili mkubwa na kivuli chini kifupi, unaonyesha shinikizo la uuzaji na hisia za soko na kutoa vidokezo muhimu kuhusu mwelekeo wa baadaye wa soko.

2. Aina za Mishale Mikubwa ya Upinzani

Mshale mkubwa wa upinzani ni aina ya mshale unaowakilisha shinikizo kubwa la uuzaji katika soko, na unakuja katika aina mbalimbali. Hapa, tutaelezea aina nne kuu kulingana na sifa zake.

2.1 Mishale ya Kawaida Mikubwa ya Upinzani

Mshale wa kawaida mkubwa wa upinzani una mwili ambao ni mkubwa sana ikilinganishwa na mishale mingine ya upinzani, ikionyesha wazi shinikizo kubwa la uuzaji. Wakati muundo huu ukijitokeza, kushuka zaidi kwa bei kunatarajiwa. Athari yake ina nguvu zaidi pale mwili wake unaonekana wazi zaidi ikilinganishwa na mishale iliyopita.

2.2 Mshale Mdogo wa Upinzani

Mshale mdogo wa upinzani una mwili mfupi na mikia, unaonyesha kutokuwa na uhakika katika soko. Unaakisi hali ambapo nguvu za uuzaji na kununua zina vita kali, na kufanya iwe vigumu kutabiri mabadiliko ya bei ya baadaye. Umbo hili linaashiria kuwa soko linaweza kuwa kwenye kizingiti cha mabadiliko.

2.3 Mshale Mkubwa wa Upinzani wenye Kivuli Chini Kirefu

Also known as a “Hammer,” this pattern is a large bearish candlestick with a long lower shadow. It appears when there was strong selling pressure initially, but then buyers stepped in, creating support. When this pattern appears in a high-price range, it suggests that sellers are dominant, and a downtrend may continue. However, if it appears in a low-price range, it can be a sign of a buyer rebound, potentially halting the price decline.

2.4 Bearish Candlestick with a Long Upper Shadow

This pattern, also known as a “Shooting Star” or “Inverted Hammer,” is a bearish candlestick with a long upper shadow. While sellers are dominant, it shows strong resistance from buyers. When this pattern is seen in a low-price range, it can indicate that buying momentum is strengthening and the market might rise. Conversely, when it appears in a high-price range, it suggests that selling pressure is intensifying, and it could be a precursor to further price declines.

2.5 Conclusion

Large bearish candlesticks come in a variety of types, each indicating different market psychologies and trends. Understanding these variations and analyzing them based on the appropriate market conditions allows you to build effective trading strategies.

3. Large Bearish Candlestick Appearance and Trends

The large bearish candlestick’s meaning can change significantly depending on where it appears on the chart, not just its shape. Here, we’ll take a closer look at the main locations where a large bearish candlestick appears and the trends associated with them.

Large Bearish Candlestick in a High-Price Range

When a large bearish candlestick appears in a high-price range, it’s considered a very important signal. This situation indicates that selling momentum has become strong, and it suggests the possibility of further price declines. A powerful selling pressure is created as market participants try to take profits.

Case Study: Large Bearish Candlestick in a High-Price Range

- Market Situation : A large bearish candlestick appears at the end of an uptrend, after breaking through a previous high.

- Implication : As buyers take profits and sellers take aggressive action, the market is highly likely to reverse.

Large Bearish Candlestick in a Low-Price Range

A large bearish candlestick in a low-price range also suggests a notable change in trend. In this case, while selling pressure increases, buyers may show strong resistance. This can be considered one of the market’s turning points.

Interpreting a Low-Price Range Candlestick

- Situation Analysis : When a large bearish candlestick appears in a low-price range, it’s crucial to observe how investors are reacting to past price levels.

- Investment Decision : It’s essential to grasp both the potential for a shift to buying and the risk of further declines.

Consecutive Large Bearish Candlesticks

When large bearish candlesticks appear consecutively, it is believed that the market’s selling pressure is extremely high, and the phenomenon known as a “Three Black Crows” (a series of three large bearish candlesticks) is particularly noteworthy. This pattern is often seen as a bottom signal, indicating that the market has completed a selling cycle.

Analyzing Consecutive Large Bearish Candlesticks

- Trend Continuation : Consecutive large bearish candlesticks are especially important in a downtrend, and while further declines are expected, it’s vital not to miss the timing for a potential rebound.

- Market Cooling Period : A cooling-off period often follows a series of large bearish candlesticks, making it essential to analyze market conditions and news during this time.

Relationship Between a Large Bearish Candlestick and Volume

When a large bearish candlestick appears, it’s also important to check the trading volume. A large bearish candlestick with high volume indicates that the signal is more reliable. Since the balance between sellers and buyers is significantly disrupted, it suggests a strong push in a particular market direction.

Volume Checkpoints

- Decline in Buying Pressure : When volume increases along with a large bearish candlestick, it suggests that market participants are supporting the downtrend.

- Reaction at Key Levels : The significance of a large bearish candlestick appearing near an important support or resistance line must be interpreted with extra care.

By understanding where large bearish candlesticks appear and the trends they signal, you can improve your trading judgment. It’s crucial to always pay attention to market movements and analyze them in combination with other technical indicators.

4. Combining the Large Bearish Candlestick with Other Technical Indicators

Large Bearish Candlestick and Moving Averages

To make the selling pressure indicated by a large bearish candlestick clearer, it’s effective to use moving averages. For example, when a large bearish candlestick appears with the price below the moving average, a continued downtrend is expected. A strong sell signal is present, especially when both short-term and long-term moving averages are simultaneously declining.

Large Bearish Candlestick and RSI (Relative Strength Index)

Next, let’s consider the approach using the RSI. If the RSI falls sharply from above 70 and a large bearish candlestick appears, it indicates that selling pressure has intensified after a period of being overbought. In this case, if the RSI falls below 50, the possibility of further decline increases. Conversely, when a large bearish candlestick appears with the RSI below 30, a potential rebound should also be considered.

Large Bearish Candlestick and Bollinger Bands

The combination with Bollinger Bands is also very effective. When the price reaches the upper band and a large bearish candlestick forms, it can be seen as a sign of reversal. In situations where the band width is narrowing, it indicates that the market is under high tension, and a sudden movement should be watched for.

Large Bearish Candlestick and Fibonacci Retracement

By combining the Fibonacci retracement with a large bearish candlestick, you can identify important support lines. When a large bearish candlestick appears at a Fibonacci retracement level (e.g., 61.8% or 78.6%), it increases the possibility that this level will become a strong reversal point. In this scenario, further declines may be expected before the price rises again.

Large Bearish Candlestick and Strong Support/Resistance

When a large bearish candlestick approaches an important support or resistance level, the subsequent price movement can change. If a large bearish candlestick appears while attempting to break through resistance, it further emphasizes that selling pressure is dominant, increasing the possibility of further decline. At these price levels, it’s also important to confirm other indicators.

Conclusion

By using these technical indicators, it becomes possible to decide on a trading strategy with higher accuracy when a large bearish candlestick appears. Since a single large bearish candlestick has its limitations, combining it with these indicators is crucial for deepening your understanding of market movements.

5. Trading Strategies Based on the Large Bearish Candlestick

The large bearish candlestick carries an important signal in the market. By using it, traders can build more effective trading strategies. Here, we’ll explain trading methods based on the large bearish candlestick.

5.1 Understanding Market Conditions

In trading based on the large bearish candlestick, it is crucial to correctly understand the market trend. When a large bearish candlestick appears, it’s important to analyze the market situation by paying attention to the following points:

- Thibitisha Mwelekeo : Wakati kibindi kikubwa cha chini kinapotokea wakati wa mwelekeo wa juu, ina uwezekano mkubwa wa kuonyesha mabadiliko ya mwelekeo. Vinginevyo, wakati kinapotokea wakati wa mwelekeo wa chini, mara nyingi kinaashiria kuharibika zaidi.

- Angalia Idadi : Idadi ya biashara wakati kibindi kikubwa cha chini kinatengenezwa pia ni muhimu. Kibindi kikubwa cha chini cha idadi kubwa inaashiria shinikizo la kuuza nguvu, kuonyesha kwamba mabadiliko ya nguvu yanaweza kuthibitishwa.

5.2 Kubaini Wakati wa Kuingia

Baada yake, hebu tuzingatie jinsi ya kubaini wakati wa kuingia kulingana na kibindi kikubwa cha chini.

5.2.1 Kutumia kama Msimu wa Uzuia

Baada ya kibindi kikubwa cha chini kutokea, kinaweza kutumika kama eneo la uzuia. Kwa hiyo, njia ifuatayo ni yenye ufanisi:

- Lenga Kurejesha : Ikiwa bei inaonyesha ufurahamu baada ya kibindi kikubwa cha chini kutokea, unaweza kuzingatia “ununuzi wa kurudi nyuma” badala ya kununua kwa kupungua. Kwa maalum, ikiwa ufurahamu hutokea karibu na kiwango cha juu cha kibindi kikubwa cha chini, inaweza kuwa fursa nzuri ya kuingia kwa kuuza.

5.2.2 Kutumia Mseto wa Uongo

Kibindi kikubwa cha chini na harakati za bei zinazofuata wakati mwingine zinaweza kujenga mseto wa uongo.

- Angalia Harakati za Bei : Angalia harakati za kibindi kadhaa zinazofuata baada ya kibindi kikubwa cha chini (haswa ikiwa kibindi cha juu kinakuja) kutafuta mabadiliko ya mwelekeo yanayoweza kutokea. Hii inafanya iwe rahisi kubaini wakati wa kuingia.

5.3 Stop-Loss na Take-Profit

Katika biashara inayotegemea kibindi kikubwa cha chini, kuweka viungo vya stop-loss na take-profit pia ni muhimu.

5.3.1 Kuweka Stop-Loss

- Ikiwa inazidi kiwango cha juu cha kibindi kikubwa cha chini : Ikiwa bei inahamia juu ya kiwango cha juu cha kibindi kikubwa cha chini baada ya kuingia, zingatia stop-loss. Kupita juu ya kiwango hiki mara nyingi hutafsiriwa kama ishara ya mabadiliko.

5.3.2 Wakati wa Take-Profit

- Kulinganisha mistari ya msaada : Wakati harakati za bei baada ya kibindi kikubwa cha chini inakaribia mstari wa msaada, inashauriwa kuchukua faida. Hii ni kwa sababu soko linaweza kurudi kwa muda mfupi.

5.4 Kuchanganya na Ishara Zingine

Kwa kuchanganya kibindi kikubwa cha chini na viashiria vingine vya kitekniki, unaweza kuongeza kiwango cha ushindi wako zaidi.

- Usawazishaji na Matarajio ya Haraka : Wakati kibindi kikubwa cha chini kinatokea karibu na mtiririko wa haraka, kinaweza kutathminiwa kama ishara imara ya shinikizo la kuuza. Kupitia kwa mtiririko wa haraka na wa muda mrefu kunaweza kuthibitisha mabadiliko ya mwelekeo.

5.5 Hatua za Kuongeza Usahihi

Katika biashara inayotumia kibindi kikubwa cha chini, ni muhimu kila wakati kuwa na uelewa wa hatua zifuatazo:

- Zingatia Urefu wa Wick : Ikiwa kivuli cha chini cha kibindi kikubwa cha chini ni mrefu sana, kinaashiria kutokuwa na uamuzi. Kwa hiyo, tahadhari inahitajika wakati wa kubaini wakati wa kuingia.

- Angalia Hali za Soko : Kwa kuwa soko linaathiriwa kwa urahisi na habari na viashiria vya kiuchumi, kumbuka kila wakati kuangalia habari za kiuchumi za hivi karibuni na hisia za soko wakati wa biashara.

Muhtasari

Kibindi kikubwa cha chini ni muundo wa kibindi unaobainisha ishara muhimu za soko. Kwa kuelewa muundo wake, eneo lake kwenye chati, na uhusiano wake na viashiria vingine vya kitekniki, wanabuni wanaweza kupima kwa usahihi hisia za soko na mwelekeo. Mikakati ya biashara inayotegemea kibindi kikubwa cha chini inaweza kusaidia kuingia sahihi na usimamizi wa hatari wakati wa kipindi cha shinikizo la kuuza linaloongezeka. Hata hivyo, ni muhimu kuchanganya na mitazamo mbalimbali ya uchambuzi badala ya kutegemea kiashiria kimoja. Wakati wa kutumia kibindi kikubwa cha chini katika biashara yako, kuangalia kwa makini harakati za soko na kuwa na uamuzi wa kubadilika utakuwa muhimu kwa mafanikio.

Maswali Yanayoulizwa Mara kwa Mara

Mshale mkubwa wa ushindo ni nini?

Mshale mkubwa wa ushindo ni aina ya mshale wa ushindo ambao hutoa ishara muhimu kwenye chati ya mishale. Una sifa ya kuwa na mwili mkubwa ambapo bei ya kufunga iko chini sana kuliko bei ya kufungua. Inaashiria shinikizo kubwa la uuzaji na inachukuliwa kama ishara kwamba bei zina uwezekano wa kushuka zaidi.

Ni mabadiliko gani tofauti ya mishale mikubwa ya ushindo?

Mishale mikubwa ya ushindo inapatikana katika mabadiliko kadhaa, ikijumuisha mshale mkubwa wa ushindo wa kawaida, mshale mdogo wa ushindo, mshale mkubwa wa ushindo wenye kivuli kirefu cha chini (Hammer), na mshale wa ushindo wenye kivuli kirefu cha juu (Shooting Star). Kila moja inaashiria psikolojia tofauti ya soko na mwenendo.

Ni wapi ni muhimu zaidi kwa mshale mkubwa wa ushindo kuonekana?

Mshale mkubwa wa ushindo ukionekana katika kiwango cha bei cha juu, unaashiria kwamba nguvu ya uuzaji imeimarika, ikionyesha uwezekano wa kushuka zaidi kwa bei. Kwa upande mwingine, mshale mkubwa wa ushindo katika kiwango cha bei cha chini unaweza kuashiria upinzani mkubwa kutoka kwa wanunuzi na unaweza kuchukuliwa kama kipengele cha mabadiliko katika soko.

Ninawezaje kutumia mshale mkubwa wa ushindo kwa pamoja na viashiria vingine vya kiufundi?

Kwa kuchanganya mshale mkubwa wa ushindo na viashiria vya kiufundi kama vile wastani wa harakati, RSI, Bollinger Bands, na retracement ya Fibonacci, unaweza kutafsiri maana yake kwa usahihi zaidi. Hii inakuwezesha kutengeneza mkakati wa biashara wenye ufanisi zaidi.