- 1 1. Introduction

- 2 2. EA Concept and Design Philosophy

- 3 3. Backtest Overview (Mock-up Data Presentation)

- 4 4. Backtest Results of Each EA (Mock-up Data Comparison)

- 5 5. Technical Innovation Points & Operational Advice

- 6 6. Frequently Asked Questions (FAQ) and Warnings

- 7 7. Summary & Disclaimer

- 8 8. Related Articles & Reference Links

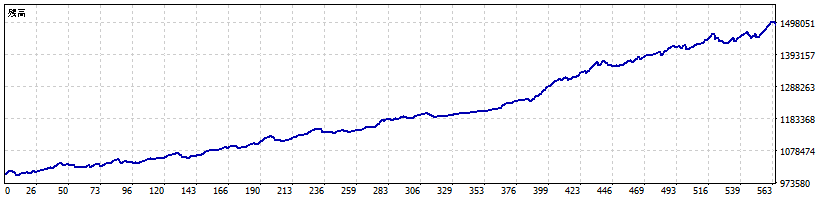

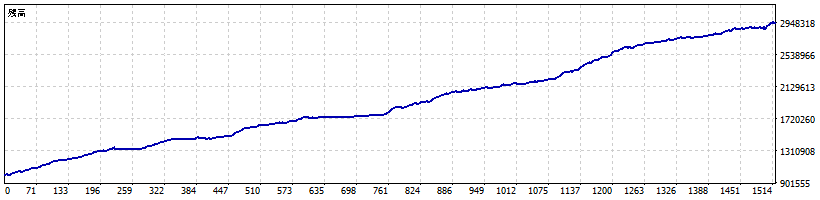

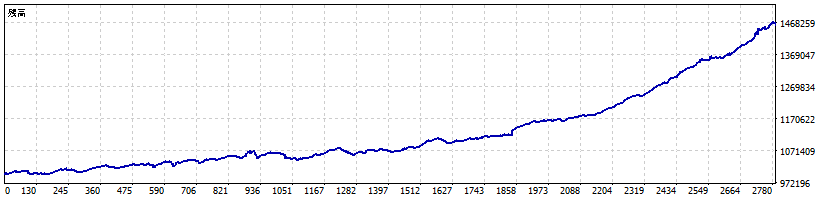

- 9 Backtest Excerpts

1. Introduction

An automated trading EA (Expert Advisor) is a highly useful tool that enables automation of trades in FX trading. Even subtle signals that might be missed in manual trading, or decisions that are easily swayed by emotion, can be executed consistently based on a defined logic when using an EA.

In this article, I introduce a technical sample of an automated trading EA for MT5 that I have independently developed. The EA is already complete, and I plan to proceed with forward testing (verification through real-time operation) in the future, but at this stage I will focus on explaining the backtest results (verification using historical data) as a preliminary step.

Please note that the EA introduced here is released as a technical sample and is not sold. Its purpose is simply to provide information that can be useful for those considering future EA development or operation, such as the mechanisms of automated trading, development philosophy, and how to interpret backtest results.

Also, investing always carries risk. The backtest results presented are based on historical market data and do not guarantee future performance. Please make your own investment decisions at your own risk.

2. EA Concept and Design Philosophy

The automated trading EA we are introducing today is designed with a focus on long-term practical experience and the ability to adapt to changing market conditions. Originally, it was developed and refined over many years as part of the “Beatrice Series” across diverse markets. However, I began to question the EA industry itself and decided to sever all ties with the industry at a certain point. This was also intended as a quiet resistance to the market, by “non-collaboration”—a passive form of attack—against problematic existing vendors. Even losing a single collaborator would be a significant blow to them, and I believed it would eventually lead to a decline in overall industry quality and stagnation.

Nevertheless, the demand for EAs and the technology itself have continued to evolve with the times. About a year ago, I restarted development and have been actively testing new methods and algorithms. To be honest, there were many failures at first, and it took some time before achieving stable performance. However, through repeated trial and error, I finally feel that I have achieved satisfactory results and stability.

In terms of EA design philosophy, we take a fairly conservative approach. We avoid taking unreasonable risks and design the system to have a certain resilience against unexpected market shocks. In particular, we strongly feel the need to respond cautiously to the extremely volatile movements in the U.S. market known as “TACO markets”—that is, market fluctuations heavily influenced by the statements and trade policies of the 47th President Trump.

(TACO stands for “Trump Always Chickens Out,” referring to the phenomenon where the market moves sharply when high tariffs or other policies are announced, but quickly reverts when Trump speaks or changes policy—an ever-changing series of directives. This impact has been especially significant in recent U.S. markets, requiring investors to be even more cautious.)

In such an environment of strong political and economic uncertainty, the EA’s design itself requires “conservatism” and “flexible risk management.” Rather than chasing returns, we focus on how to withstand large drawdowns and unexpected price movements—this perspective shapes our development and operational policy.

3. Backtest Overview (Mock-up Data Presentation)

In the development and evaluation of an EA, backtesting is an indispensable process. Backtesting is a method that virtually runs the EA’s logic based on historical exchange rates and transaction data, and verifies what kind of performance it actually achieves. It is performed to understand the EA’s performance, risk tolerance, and quirks of its logic before forward testing (operation in real or demo accounts).

The EA introduced here runs on the MetaTrader 5 (MT5) platform and performs backtests using historical data from Ava Trade Ltd.. The conditions of the backtesting environment are as follows.

- Test Period

Beatrice Zenon, Shamir, Elion: January 1, 2015 – June 14, 2025

Beatrice Ariel: January 1, 2010 – June 14, 2025 - Target Currency Pairs

Zenon, Elion, Ariel: USDJPY

Shamir: EURUSD - Timeframe Used

All are M1 (1-minute) data - Initial Margin & Leverage

¥1,000,000, leverage 1:50 - Lot Size & Risk Management

Detailed settings for each EA (e.g., fixed lot, Martingale control, etc.) differ individually, but all aim to mitigate risk. - History Quality

All verified at 99% history quality

Backtesting helps visualize the EA’s general tendencies and expected risks before operation. However, the results of backtesting are only performance based on past data and do not guarantee future operational results. Especially in recent cases like the ‘TACO market’, where political factors cause rapid market fluctuations repeatedly, many situations may not match the backtest results.

Therefore, we would like you to view the published backtest results as a ‘mock-up’ for reference. We plan to report progress on forward testing and changes in real-time operation in future articles and on social media as they occur.

4. Backtest Results of Each EA (Mock-up Data Comparison)

Here, we introduce the main backtest results of each of our proprietary EAs (Beatrice Zenon, Shamir, Elion, Ariel) in a summary format.

Each EA has different logic and risk management policies, and the target currency pairs and parameters also differ. Through tables and key indicators, we have summarized the characteristics and performance trends at a glance.

■ Backtest Key Indicator Comparison (2015-2025, Ariel only 2010-)

| EA Name | Currency Pair | Total P&L | Profit Factor | Max Drawdown | Win Rate | Number of Trades |

|---|---|---|---|---|---|---|

| Zenon | USDJPY | 488,217 | 1.94 | 32,529 (2%) | 66.19% | 562 |

| Shamir | EURUSD | 1,943,780 | 2.19 | 34,731 (1%) | 61.40% | 1,518 |

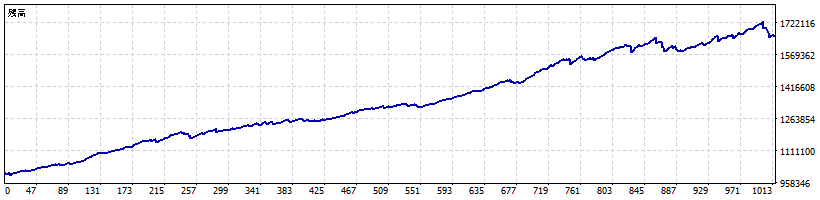

| Elion | USDJPY | 664,556 | 1.66 | 79,191 (5%) | 73.81% | 1,012 |

| Ariel | USDJPY | 461,139 | 1.54 | 27,936 (3%) | 72.86% | 2,782 |

● Beatrice Zenon

Targeting USDJPY, it adopts a relatively medium-risk, medium-return logic. With a win rate of 66.19% and a maximum drawdown kept in the low 2% range, it is characterized by overall stable behavior. In backtests, there are few large losing streaks, and its recovery ability is considered high.

● Beatrice Shamir

Dedicated EA for EURUSD. With a win rate over 60% and many trades, it records a balanced performance with a profit factor of 2.19. The maximum drawdown is also kept in the low 1% range, giving an impression of somewhat conservative behavior.

● Beatrice Elion

Designed for USDJPY, it offers a relatively aggressive setting option. The maximum drawdown is somewhat large at 5%, but the win rate is high at 73.81%. Short-term streaks of wins and losses can be observed, making it easy to ride market waves, but management during sudden volatility must also be considered.

● Beatrice Ariel

A USDJPY-only EA with long-term backtest data (since 2010). It has a win rate of 72.86% and a maximum drawdown of 3%. With a large number of trades, its per-trade P&L is modest, but its steady, incremental performance shines.

※Please Note

These results are only backtest results (mock-up) based on past data.

Recent market conditions and unexpected price movements caused by political factors such as the “TACO market” can occur in real operations.

It is important not to over-rely on backtest data alone and to always pay attention to the latest risk information during operation.

5. Technical Innovation Points & Operational Advice

The EA group I developed is designed on the premise that it can operate with a focus on stability without taking excessive risk. While the details of the trading logic differ for each EA, we emphasize the following common technical innovations and safety measures.

● Technical Innovations & Safety Assurance

- Slippage & Spread Management

To avoid excessive unfavorable executions even in unstable market conditions or sudden price movements, we set clear upper limits for slippage and spread. This reduces the risk of unexpected cost increases. - Lot Control and Capital Management

Fixed lots or risk-percentage settings, and, when necessary, support for multiple patterns such as Martingale. By strictly controlling maximum lot size and margin maintenance ratio, we implement an algorithm that automatically avoids excessive risk. - Drawdown Control

We incorporate an automatic safety feature that stops trading, reduces lot size, or sends alert notifications when the maximum drawdown exceeds a set threshold. This helps minimize risk even during unexpected losing streaks or significant asset declines. - Logic Optimization During Backtesting

We exercise caution when optimizing backtest data to avoid “curve fitting” (overfitting to past data to the point of being useless in live operation) and keep the implementation logic as simple as possible.

● Advice for Live Operation

- Currently, it is purely a “technical sample”

This EA is not intended for sale, and there are no plans to distribute or license it at this time. We have no intention of commercial sales in the future; the focus remains on technical validation, personal asset management, and knowledge accumulation. - Interested in Signal Distribution & Logic Provision

Within the bounds of Japanese regulations, if requested, I have some interest in providing signal distribution or certain logic, as well as technical explanations. This differs from selling a finished EA; it is a proactive approach to communication through investment advice or strategy sharing. - Progress Report on Forward Testing

We currently publish backtest results, but we plan to release regular reports on live (demo or real) forward testing in the future. We will continue to share how the EA performs in real market conditions.

When adopting an EA, don’t be swayed by sales or performance figures; prioritize security, transparency, and the operator’s own confidence—this is the essence of building long-term profits.

6. Frequently Asked Questions (FAQ) and Warnings

Here, we summarize the common questions often asked by readers and those interested in FX automated trading, as well as key points to pay particular attention to when using an EA.

For safe operation and to avoid trouble, please read it carefully.

Q1: Why don’t you sell the EA?

We are confident in the completeness of the EA itself, but operating with a “sell-first” approach involves various risks, including support structure, users’ investment styles, and alignment with domestic and international financial regulations.

Additionally, there are many legal restrictions on selling EAs within Japan, and even a slight ambiguity could lead to trouble.

For these reasons, we currently have no intention of selling or distributing the EA to individuals.

Q2: Is it possible to provide signal distribution or part of the logic?

We do not sell the finished EA, but we are open to providing signal distribution within the bounds of domestic regulations and sharing parts of the algorithmic ideas.

For those who need specific trading logic or market analysis insights, we may be able to accommodate them on a case-by-case basis.

Q3: Can you judge the quality of an EA solely based on backtest results?

Backtests are merely simulation results based on past data.

Especially in recent markets like the “TACO market”, where political factors or sudden news can greatly disrupt the market, there is no guarantee that you can operate in line with past backtest performance.

Before actual operation, we recommend conducting forward testing on a demo account and observing real-time performance thoroughly.

Q4: How should I think about operational risk?

Every EA carries risk. Even if the win rate or profit factor is high, it does not mean you will never lose.

The important thing is to clearly decide in advance how much drawdown you can tolerate and where you will cut losses or stop operation in case of unexpected loss.

Q5: Can I inquire about operation or logic?

We will respond to individual operational consultations and algorithm-related questions as much as possible, depending on the content.

However, the advice is limited to technical viewpoints and generalities, and we do not provide specific investment decisions or direct trade instructions.

The principle is “self-determination and self-responsibility,” so we appreciate your understanding.

⚠️ Warning

- Using an EA is a tool to aid investment decisions, but there is always a risk of loss.

- In particular, be cautious of exaggerated claims like “everyone can easily make money” or “never lose”.

- Correct knowledge and calm risk management are the keys to maintaining long-term stable operation.

7. Summary & Disclaimer

In this article, I introduced a wide range of topics about the technical sample of an MT5 automated trading EA that I independently developed, from its design philosophy to back‑test results, technical innovations, and operational cautions.

EA is a convenient tool that is fully automated, but its essence is simply one strategy, and past performance does not guarantee future success.

My EA prioritizes a design that eliminates excessive risk and is conservative and solid.

Also, I am not currently selling the EA itself; I only provide signal distribution, share ideas for some logic, and offer technical advice as needed.

This is because I prioritize transparency and trust with users.

Back‑test data is kept only as reference information in the form of a mock‑up, and you must always operate it at your own risk.

Market conditions are constantly changing, and sudden political or economic events—especially recent ones like the “TACO market”—can pose significant risk of unexpected volatility.

I recommend that you use the EA only in line with your own risk tolerance and asset situation, and do so calmly and strategically.

In the future, I plan to continuously share updates on forward testing (real operation), insights, and technical topics through this site and social media.

If you are interested in EA or automated trading, I would be grateful if you continue to check it out.

Disclaimer

The content in this article does not directly recommend investment advice or asset management. Trading via EA or automated trading does not guarantee principal and may result in losses. Final investment decisions must be made by yourself.

I accept questions and consultations about the article content or technical information, but I cannot take any responsibility for individual cases, so please understand in advance.

8. Related Articles & Reference Links

For those interested in automated trading EAs and MT5 operation, and for those looking to deepen their knowledge, we present several useful related articles and official resources. Use them as practical tips for real-world operation and development.

● Recommended Articles for EA Development & Operation

The use of EAs (automatic trading systems) in FX has garnered interest from many traders, ranging from beginners to expe[…]

1. Introduction Choosing to Build Your Own FX Automated Trading Program In recent years, even among individual investo[…]

This article provides a detailed explanation of Tick Data Suite, a backtesting tool. Tick Data Suite is a unique tool th[…]

<はじめに> このサイトはプログラミング言語MQL5で、MT5用のEA(自動売買プログラム:エキスパートアドバイザー)を…

当サイトはMetaQuotes Software社のMT4(メタトレーダー4)で、EA(自動売買)やカスタムインジケータ…

FX会社一覧比較から無料EA配布企画などを行っています。MT4/MT5の使い方や初心者がFXを始めるまでのステップ、MQ…

● Resources for Engineers & Intermediate to Advanced Users

- MQL5 Official Documentation

Detailed explanations of MQL5, the EA development language, along with function references and a collection of code samples.

MetaQuotes Official Site (English) - MetaTrader 5 User Community

Forums and Q&A are active, with information exchange among developers worldwide. Many strategy tips and bug reports are also gathered.

MetaTrader 5 Official Community (English)

● Other Useful Sites & Resources

- Financial Services Agency “Notice of Caution Regarding the Use of Automated Trading Tools, Signal Distribution, etc.”

You can check official information on domestic regulations and precautions when using EA or signal distribution.

Financial Services Agency Official Site - FX Industry News & Latest Trends

It is important to keep up daily with the latest FX industry news, such as the TACO market, which has strong current events.

Yahoo! News (Foreign Exchange Market)