Slippage in FX trading is one of the concepts that can be difficult for beginners to understand. However, correctly understanding slippage and taking appropriate measures is extremely important for safe and effective trading. In this blog, we explain the definition of slippage, its causes, and how to set acceptable slippage as a countermeasure in an easy-to-understand way. This blog is packed with information useful not only for FX beginners but also for intermediate and advanced traders, so please give it a read.

- 1 1. What is slippage? Explained in an easy-to-understand way for beginners

- 2 2. Why Does Slippage Occur? A Thorough Explanation of the Main Causes

- 3 3. Understand the Basics and Mechanism of Acceptable Slippage

- 4 4. Specific Settings and Guidelines for Acceptable Slippage

- 5 5. Prevent Losses with Recommended Acceptable Slippage Settings

- 6 Summary

- 7 Frequently Asked Questions

- 8 Reference Sites

1. What is slippage? Explained in an easy-to-understand way for beginners

In FX trading, the term “slippage” is something you hear frequently. For FX beginners, it is extremely important to understand this concept correctly. So, specifically, what does slippage mean?

Definition of slippage

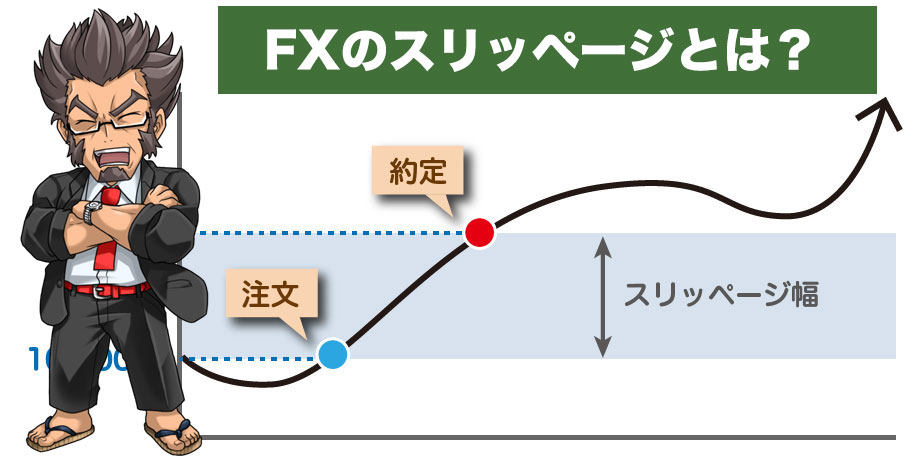

Slippage refers to the price difference that occurs between the order price set by the trader and the price at which the trade actually settles. For example, if you try to buy 1 dollar at 100 yen, and the price changes at the moment the order is confirmed, resulting in a settlement at 100.05 yen, the 0.05 yen difference is slippage.

Mechanism of slippage occurrence

Slippage occurs due to several factors.

- Market liquidity: When the number of market participants is low or when there are sharp price movements, price volatility increases, making slippage more likely.

- Time lag: The time it takes for an order to reach the broker’s server can cause price changes. Even a few seconds of lag can be a cause of slippage.

- Server load: When many traders place orders simultaneously, the server can become overloaded, causing delays in order processing, which is also a factor in slippage.

Impact of slippage

When slippage occurs, traders are settled at a price different from the intended one, creating unexpected loss risk. Especially in short-term trades like scalping, even a small price difference can have a large impact, so understanding slippage is very important.

Slippage countermeasures

It is not easy to completely prevent slippage, but the following measures can reduce the risk.

- Setting an acceptable slippage limit: By pre-setting the price difference you are willing to accept, you can reduce the risk of settling at an unintended price.

- Selecting a trading environment: Trading in markets with high-performance servers and sufficient liquidity can suppress the occurrence of slippage.

Thus, knowledge about slippage and its countermeasures is very important in FX trading. In the FX market where price changes instantly affect outcomes, deepening your understanding of slippage and taking appropriate measures can improve the probability of successful trades.

2. Why Does Slippage Occur? A Thorough Explanation of the Main Causes

In FX trading, the primary cause of slippage is the time lag between placing an order and its execution. This delay can cause a discrepancy between the price a trader intends and the price at which the trade actually settles, making slippage an unavoidable phenomenon. Below, we explain the specific reasons why slippage occurs in detail.

Impact of Internet Connection

It takes time for the information to reach the FX company’s server after a trader clicks the order button. In particular, the following factors influence this.

- Communication speed: Generally, a slower internet connection means longer information transfer times, increasing the likelihood of price changes.

- Network congestion: When trading activity is high or overlaps with other online activities, the network can become congested, causing time lag.

FX Company’s Processing Capacity

Slippage also heavily depends on how quickly the FX company processes traders’ orders. The following situations can occur.

- Server performance: If the FX company’s server is handling many orders, its processing capacity may be insufficient, leading to delays. This is especially pronounced during market instability or when economic indicators are released, causing traffic spikes.

- System load: If the FX company’s trading system is under high load, delays can occur before order execution, increasing the likelihood of slippage.

Sudden Price Movements

When market movements are intense, slippage is especially likely. Prices can change dramatically at the moment a trader places an order.

- Important news or economic indicator releases: Financial markets are sensitive to economic releases and political events. Trading during these times increases slippage risk.

- Liquidity decline: In certain time periods or market conditions, liquidity can drop, making prices more volatile. In such situations, it becomes difficult to execute trades at desired prices.

Understanding the causes of slippage enables you to implement more effective countermeasures. As a trader, it is essential to take solid steps to mitigate these risks.

3. Understand the Basics and Mechanism of Acceptable Slippage

Slippage refers to the difference between the price at which an order is placed and the price at which it is actually executed. This phenomenon is especially common in FX and stock trading, and is an important factor for traders. Therefore, we will explain in detail the basic concept of acceptable slippage and its mechanism.

What is Acceptable Slippage?

Acceptable slippage refers to the “slippage tolerance range” that traders can set in advance. Specifically, by determining the width of slippage you are willing to accept at the time of placing an order, you can check whether the actual execution falls within that range. If slippage exceeds the set value, the order is automatically canceled. This setting allows you to prevent unexpected losses, especially when sharp price movements occur.

How the Settings Work

Setting acceptable slippage is very simple. The specific method is as follows:

- Log in to your trading platform and open the order screen.

- Find the slippage setting field (many FX brokers display it as “Acceptable Slippage”).

- Enter your desired slippage as a numeric value. For example, entering “3 pips” will allow slippage within 3 pips; any greater deviation will result in cancellation.

Key Points for Success

There are several points to consider when setting acceptable slippage. The following are good to keep in mind:

- Set according to your trading style: The optimal acceptable slippage varies by trading style, such as scalping or day trading. For example, setting 0–0.3 pips is effective for scalping.

- Check market conditions: When the market is active or around economic releases, slippage is more likely, so consider setting a wider acceptable slippage. Generally, if sharp price movements are expected, a setting of 5–10 pips may be worth considering.

Things to Be Careful About

When setting acceptable slippage, it is important to keep the following points in mind:

- Risk of cancellation: Setting acceptable slippage too strictly can lead to unexpected cancellations, causing you to miss important trading opportunities.

- Consideration of trade volume: When trade volume is high, the impact of slippage can be more pronounced. Especially when taking profits, it is important to keep this in mind.

Thus, acceptable slippage is an important setting that helps reduce unexpected risks while facilitating smooth trading.

4. Specific Settings and Guidelines for Acceptable Slippage

In FX trading, setting the acceptable slippage is very important. This setting allows you to determine the width of slippage you can accept, and it can prevent unexpected losses. Let’s look in detail at the specific settings and guidelines.

How to Set It

Check the trading platform

First, open the trading platform you are using. Many FX brokers provide trading tools such as MT4 and MT5. These tools have an option to set acceptable slippage.Access the settings screen

Move to the trading screen and select options such as ‘Order’ or ‘Settings’. In MT4, look for the ‘Trade’ tab in the options window, check ‘Specify default’, and enter the slippage value.Enter the acceptable slippage value

Input the desired slippage width in pips. For example, if you set it to 3 pips, orders will be canceled if the price moves more than 3 pips.

Guidelines for Settings

The width of acceptable slippage varies depending on your trading style and market conditions. Specifically, the following guidelines exist.

Scalping: 0–0.3 pips

Scalping requires short-term, rapid trades, so it’s important to set a narrow slippage width as much as possible.Minor currency pairs: 5–10 pips

When dealing with minor currencies that often have larger price movements, setting a larger width can help execute trades smoothly.Other currency pairs: about 3 pips

For typical currency pairs, a setting that doesn’t significantly affect P&L is desirable. About 3 pips allows relatively stable trading.

Things to Keep in Mind When Setting

When setting acceptable slippage, it’s important to pay attention to the following points:

Consider periods of high volatility

During economic indicator releases or sudden market changes, it may be necessary to set a wider slippage than usual.Understand the risk of cancellation

If the set slippage is exceeded, the order may be canceled, which can affect trade timing, so keep that in mind.

In this way, setting acceptable slippage needs to be done flexibly according to your trading style and risk management. With the correct settings, you can achieve stable trading.

5. Prevent Losses with Recommended Acceptable Slippage Settings

In FX trading, setting an acceptable slippage is an essential factor for success. Defining an appropriate slippage range helps avoid unexpected losses. Therefore, it is necessary to set an acceptable slippage that accurately matches your trading style and market conditions.

Acceptable Slippage Settings by Trading Style

In the FX market, the recommended acceptable slippage varies by trading style. Below, we detail recommended settings based on major trading styles.

Scalping: 0–0.3 pips

In scalping, to capture the fine movements of price changes, it is necessary to minimize the impact of slippage. Therefore, the acceptable range should be set as narrow as possible.When trading minor currencies: 5–10 pips

Minor currencies such as GBP/JPY or ZAR/JPY have lower liquidity, so setting a narrow slippage range makes execution difficult. Therefore, it is desirable to set a slightly wider acceptable range.Other trading styles: About 3 pips

For trading typical currency pairs, a setting of around 3 pips is appropriate. Within this range, you can avoid large losses while ensuring smooth execution.

Points to Consider When Setting

When setting acceptable slippage, it is essential to consider several points. Understanding these considerations will help you achieve more effective trading.

Consider market liquidity

During times of lower liquidity or specific events, slippage is more likely to occur. Especially around the release of economic indicators, we recommend widening the slippage range.Pay attention to trade volume

When executing large trades, the impact of slippage becomes more pronounced. Adjusting the acceptable range appropriately for each position size is important.Balance reliability and smoothness

Setting slippage too narrow can make execution difficult, while widening it makes execution easier. Therefore, it is important to choose a setting that matches your trading style.

Finding a Setting That Fits You

The acceptable slippage setting may need to be changed after you decide it. It is very important to review it in response to market trends and changes in your trading style. To find the optimal setting, it is effective to actually carry out several trades and observe execution conditions.

By considering these factors and setting an appropriate acceptable slippage, you can reduce risk while maximizing profits, which is the key to success in FX trading.

Summary

In FX trading, slippage is an unavoidable phenomenon. However, by setting an appropriate acceptable slippage, you can avoid unexpected losses. It is important to flexibly set it according to your trading style and market conditions, and find the optimal slippage range for yourself. By deepening your understanding of slippage and paying attention to its settings, you can achieve stable and effective FX trading.

Frequently Asked Questions

What is slippage?

Slippage refers to the price difference that occurs between the order price set by a trader and the actual execution price. It arises from factors such as market liquidity, time lag, and server load.

Why does slippage occur?

The main cause of slippage is the time lag between the order being placed and its execution. Delays that arise during the transmission of order information—such as internet connection speed, the processing capacity of the FX broker, and sudden price movements—create the difference between the order price and the execution price.

What is acceptable slippage?

Acceptable slippage refers to the range of slippage that a trader can predefine. With this setting, the system checks whether the actual execution falls within that range, and if it exceeds the limit, the order is automatically canceled.

How to set acceptable slippage and what are the guidelines?

To set acceptable slippage, you do so on the order screen of your trading platform. Enter the slippage width in pips, and if the execution falls within that range, the trade will be executed. Typical guidelines are 0–0.3 pips for scalping, 5–10 pips for minor currencies, and about 3 pips for other cases.

Reference Sites

FXのスリッページについて解説する記事です。スリッページが発生する原因やメリット・デメリット、スプレッドとの違いを解説し…

FXってなに?いくらから始める?リスクは?どう勉強すればいいの?おすすめのFX会社は?プロトレーダーがFXの基礎から勝ち…

FXのスリッページは「注文価格通りに注文が通らない事象」です。何も対策しないと不利な価格でトレードすることになり想定外の…

FX取引を行う上で一度は聞くスリッページとは何か、なぜ発生するのかなども徹底解説!対処法も含めて紹介しています。実際の取…