In investing and trading, performance metrics are extremely important. The recovery factor and profit factor are representative metrics, but it is essential to understand the differences between them. This blog provides a detailed explanation of the concepts, calculation methods, and applications of the recovery factor and profit factor. Packed with tips to accurately assess investment performance and manage risk, be sure to check it out.

- 1 1. What is the Recovery Factor? Basic explanation for beginners

- 2 2. Master the Calculation Method of the Recovery Factor

- 3 3. Understanding the Difference with Profit Factor

- 4 4. How to Use Recovery Factor to Help Choose an EA

- 5 5. Ideal Numbers from the Perspective of Risk and Return

- 6 Summary

- 7 Frequently Asked Questions

- 8 Reference Links

1. What is the Recovery Factor? Basic explanation for beginners

The Recovery Factor (RF) is one of the important metrics in investment and trading. This metric indicates how much return can be expected relative to risk, and is generally also called the risk-return ratio. In particular, when using an automated trading system (EA), understanding this recovery factor is essential.

Formula for the Recovery Factor

The recovery factor can be calculated using the following formula.

Recovery Factor (RF) = Net Profit ÷ Maximum Drawdown

- Net Profit: Profit earned from the entire trade.

- Maximum Drawdown: The largest loss experienced during the trade process.

For example, if an EA has a net profit of 1,000,000 yen and a maximum drawdown of 500,000 yen, the recovery factor would be 2.0. This means there is a possibility of earning twice the original capital.

Why is the Recovery Factor Important?

A higher recovery factor indicates that you can expect larger returns with less risk. Therefore, this metric is very valuable for investors and traders. Below are the reasons for emphasizing the recovery factor.

- Risk Management: By checking the relationship between maximum drawdown and net profit, you can manage risk appropriately.

- EA Evaluation: An EA with a good recovery factor is more likely to demonstrate relatively superior performance.

- Capital Efficiency: To increase the efficiency of invested capital, you can appropriately evaluate the return-to-risk balance.

Guidelines for the Recovery Factor

Generally, a recovery factor of 1.0 or higher is considered good performance, and 10.0 or higher is considered very excellent. However, the nature and duration of the underlying trades are also important, not just the recovery factor. In some publications and sources, a recovery factor of 10 or higher over more than 10 years of operation is often regarded as excellent.

How to Use the Recovery Factor

When using the recovery factor, it is important to pay attention to the following points.

- Backtest Period: A recovery factor calculated over a short period may be less reliable.

- Relative Comparison: Comparing with other EAs or systems allows for a more accurate evaluation.

- Annual Average (YRF): Calculate the annual recovery factor and also consider the speed of capital recovery.

Thus, the recovery factor is an important tool for effectively evaluating investment strategies and is an easily understandable metric even for beginners. By considering the balance of risk and return from multiple angles, you can make better investment decisions.

2. Master the Calculation Method of the Recovery Factor

The recovery factor (RF) is a crucial metric for evaluating trade performance. It is calculated by dividing the Net Profit by the Maximum Drawdown. This calculation provides a clear understanding of the balance between risk and return.

Calculation Formula

The basic formula to calculate the recovery factor is as follows:

![]()

Example Calculation

For example, suppose the backtest results of an EA yielded the following numbers.

- Net Profit: 1 million yen (1 million yen)

- Maximum Drawdown: 500,000 yen (500,000 yen)

In this case, the recovery factor is calculated as follows:

![]()

This value indicates relatively low risk and the potential for good returns.

Multiple Scenarios

By calculating the recovery factor across different scenarios, you can compare the performance of EAs. Let’s consider the following examples:

Scenario 1

- Net Profit: 2 million yen (2 million yen)

- Maximum Drawdown: 1 million yen (1 million yen)

- RF:

Scenario 2

- Net Profit: 1.5 million yen (1.5 million yen)

- Maximum Drawdown: 750,000 yen (750,000 yen)

- RF:

Scenario 3

- Net Profit: 1 million yen (1 million yen)

- Maximum Drawdown: 3 million yen (3 million yen)

- RF:

By comparing the recovery factor in this way, you can clearly determine which EA offers higher returns relative to risk.

Key Points

- The higher the number, the better: A higher recovery factor indicates better performance. Generally, a recovery factor of 1 or above is desirable, and a value of 10 or higher is considered excellent.

- Useful for risk management: Using the recovery factor allows traders to intuitively understand returns that match their risk.

- The importance of backtesting: When performing this calculation in practice, backtest data is essential. Calculating the recovery factor based on historical data helps assess the effectiveness of an EA.

Leverage this knowledge to master the calculation of the recovery factor and drive your trading success.

3. Understanding the Difference with Profit Factor

The well‑known metric for measuring investment performance is the Profit Factor, but there is also an equally important metric called the Recovery Factor. These two metrics evaluate investment results from different perspectives, but they are often confused. Here, we will clarify the differences between the Recovery Factor and the Profit Factor and consider the importance of each.

Overview of the Profit Factor

The Profit Factor is calculated by dividing total profit by total loss. When this value exceeds 1, it indicates that profits were made during the test period. A higher number is considered more efficient, and a value of 1.2 or above is regarded as excellent. The Profit Factor serves as a basic metric for measuring the success of an investment strategy, but it has limitations because it does not take the magnitude of losses into account.

The Appeal of the Recovery Factor

On the other hand, the Recovery Factor is calculated by dividing total profit by the maximum drawdown. This metric indicates how much risk (maximum drawdown) was involved relative to the profits earned. Especially in financial markets, the ability to recover from losses is important, so the Recovery Factor is a highly valuable metric.

How Their Uses Differ?

- Risk Management: The Profit Factor mainly shows the balance between profits and losses, whereas the Recovery Factor shows how much risk was taken to earn profits. Therefore, investors who prioritize risk should focus on the Recovery Factor.

- Evaluating Investment Strategies: A strategy with a high Profit Factor is not necessarily safe. For example, a high Profit Factor strategy that comes with a very large maximum drawdown actually poses significant risk to investors. If the Recovery Factor is low, one should be cautious when evaluating that strategy.

- Visualizing Performance: The Profit Factor is based on the total gains and total losses, whereas the Recovery Factor specifically shows the time and risk involved in recovering from losses, thereby visualizing long‑term performance.

Summary of Importance

The Recovery Factor and Profit Factor provide different perspectives when evaluating investment strategies. The Recovery Factor is especially a crucial metric for investors who prioritize resilience to losses. Even if the Profit Factor is excellent, a low Recovery Factor may mean the strategy is not sustainable. Therefore, considering both metrics together leads to investment success.

4. How to Use Recovery Factor to Help Choose an EA

When selecting an automated trading system (EA), the recovery factor is a very important metric. Through this metric, you can understand the potential of the EA and make more appropriate investment decisions. Below, we explain in detail how to use the recovery factor.

Basic Significance of the Recovery Factor

The recovery factor is calculated by dividing the net profit by the maximum drawdown. A higher value indicates greater profit relative to risk, suggesting the EA can be expected to perform stably. Specifically, if the recovery factor is as follows, it can serve as a good selection criterion.

- Below 1.0: The return does not justify the risk, so caution is needed.

- 1.0 or above: An EA that can generate profit for a given level of risk.

- 10.0 or above: Evidence of a very excellent EA. Likely to produce solid profits.

Key Points When Comparing and Evaluating

When choosing an EA, it is important not to rely solely on the recovery factor but to consider it in combination with other factors. Refer to the following checkpoints.

- Backtest duration: The recovery factor value is heavily influenced by the length of the backtest period. Generally, values derived from longer-term tests are more reliable.

- Maximum drawdown record: Even with a high recovery factor, a large maximum drawdown indicates risk. It is important to select within an acceptable risk range.

- Relationship with expected gain: EAs with high expected gains often have good recovery factors. Verify that the expected gain per trade is positive.

Concrete Selection Method Using Recovery Factor

We introduce the method for selecting an EA using the recovery factor.

- Step 1: List multiple EAs and record each one’s recovery factor.

- Step 2: Check each EA’s maximum drawdown and backtest duration to assess risk.

- Step 3: Choose the most balanced EA based on statistical data. At this point, consider not only the recovery factor but also overall performance.

By effectively using the recovery factor in this way, you can choose the best EA that fits your investment style. Maximize the potential of the selected EA.

5. Ideal Numbers from the Perspective of Risk and Return

The recovery factor is an important metric that indicates how much return can be expected relative to risk. Understanding this number is extremely helpful for traders when selecting an Expert Advisor (EA), but what constitutes an ideal value?

Ideal Criteria for the Recovery Factor

Generally, an ideal recovery factor is considered to be 2.0 or higher. This means you can expect returns that are more than twice the risk. Paying attention to the following points makes it easier to assess the quality of the factor.

- Higher value: The higher the recovery factor, the greater the return relative to risk. For example, an RF of 3.0 indicates a net profit that is one-third of the risk.

- Lower value: If the recovery factor is below 1.0, losses exceed profits, meaning you are essentially taking on risk without adequate reward.

Relationship with the Risk-Return Ratio

When evaluating the recovery factor, you should also consider the risk-return ratio. It is calculated as follows:

- Risk-return ratio (Ret/DD) = Total profit ÷ Maximum drawdown

The higher this risk-return ratio, the better the return relative to risk. Ideally, a ratio of 2 or higher makes the investment attractive.

Adjustments and Considerations

However, it is risky to feel secure simply because the numbers exceed the benchmark. Keep the following points in mind as well.

- Changes in market conditions: Since the recovery factor can fluctuate with market conditions, it is essential not to rely solely on past good results.

- Performance of entry positions: The recovery factor is also affected by the entry positions held by each EA, so a detailed evaluation is necessary.

Summarized Ideal Numbers

- Recovery factor: Ideal is 2.0 or higher

- Risk-return ratio: Benchmark is 2 or higher

- Check market conditions: Always verify the latest information

Using these criteria as a reference, it is important to find an EA that matches your own risk tolerance and trading style. Choosing an EA with ideal numbers enables efficient trading while minimizing risk.

Summary

The recovery factor is a very important metric for evaluating investment and trading performance. By understanding and appropriately utilizing this figure, you can achieve efficient returns while controlling risk. In particular, when selecting an automated trading system (EA), it is wise to consider various factors comprehensively with the recovery factor as the focal point. If the recovery factor is 2.0 or higher and the risk‑return ratio is 2 or greater, it can be said to be an attractive investment target. However, you must also pay attention to finer details such as changes in market conditions and position performance. Understanding the recovery factor and making appropriate investment decisions based on it should lead to long‑term stable earnings.

Frequently Asked Questions

What is the Recovery Factor?

The Recovery Factor (RF) is an important metric that indicates the return on risk in investments and trading. It is calculated by dividing net profit by maximum drawdown, and a higher value means a greater return relative to risk. Generally, a value of 1.0 or higher is considered good performance.

How do I calculate the Recovery Factor?

The Recovery Factor is calculated by dividing “net profit” by “maximum drawdown.” For example, if net profit is 1,000,000 yen and maximum drawdown is 500,000 yen, the Recovery Factor would be 2.0. This figure indicates how much profit an investor can earn relative to risk.

What is the difference between the Recovery Factor and the Profit Factor?

The Profit Factor is calculated by dividing total profit by total loss, whereas the Recovery Factor is calculated by dividing net profit by maximum drawdown. The Profit Factor shows the balance between profits and losses, while the Recovery Factor indicates the magnitude of return relative to risk. Considering both together allows for more appropriate investment decisions.

What is an ideal value for the Recovery Factor?

Generally, a Recovery Factor of 2.0 or higher is considered good performance. This figure means you can expect returns that are more than twice the risk. Additionally, a risk-return ratio (Ret/DD) of 2 or higher indicates superior returns relative to risk. However, you should also be mindful of changes in market conditions.

Reference Links

リスクリターン率(Ret/DD)について EAを選ぶ時にリスクリターン率(Ret/DD)を使用している方も多いと思います…

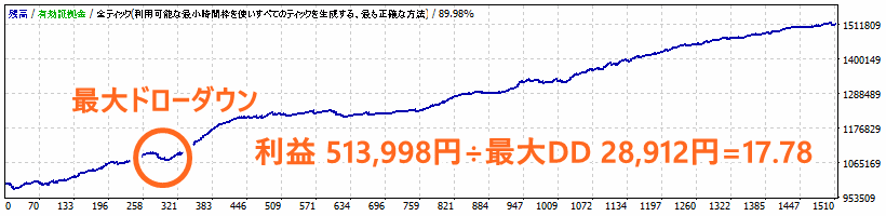

UNICLOPSはUSD/JPYに対応したスキャルピング型EAです。2004年から2024年の20年間にわたるバックテス…

Trader Kaibe氏の監修記事です。世界でも有名なFXトレード大会『ロビンスカップ』で、準優勝という実績を持ちます…