In trading, keeping thorough records is extremely important. By using a trade journal, you can review past trades and understand your strengths and weaknesses. This blog provides a detailed explanation of the importance of trade journals, effective ways to write them, and strategies to prevent mistakes. Packed with valuable information to promote your growth as a trader, we invite you to take a look.

- 1 1. The Importance of a Trade Note? Basics Beginners Should Know

- 2 2. Learn from Pro Traders! How to Write Effective Trade Notes

- 3 3. Preventing Common Mistakes and Managing Mental Health with a Trade Journal!

- 4 4. Easy to Continue! How to Create Trade Notes Using Digital Tools

- 5 5. Visualizing Trading Performance and Skill Improvement Using Trade Notes

- 6 Summary

- 7 Frequently Asked Questions

- 8 Reference Sites

1. The Importance of a Trade Note? Basics Beginners Should Know

A trade note is not only a record of individual trades but also an essential tool that promotes growth as a trader. Especially for beginners, it becomes a valuable means to review their trades and identify challenges. Let’s take a closer look at the importance of trade notes.

Benefits of a Trade Note

1. Organizing Emotions

Trading can sometimes involve emotional decisions. The joy of winning or the frustration of losing can influence a trader’s thinking. By keeping a trade note, you can organize the emotions and decision‑making context of the day. This creates an environment where you can make calm judgments in your next trade.

2. Understanding Trade Tendencies

Reviewing your trade notes regularly helps you understand your own trading tendencies. Pay attention to the following points when recording.

- Commonalities of Successful Trades: Which market conditions led to success

- Causes of Failed Trades: Common mistakes or emotional swings

- Timing of Entry and Exit: Which timing was effective

By recording these, your strengths and weaknesses gradually become clear, allowing you to build more effective trading strategies.

3. Foundation for Self‑Improvement

Trading is a continuous learning process. By reviewing your performance through a trade note, it becomes easier to identify areas for improvement. For example, you can analyze why something didn’t work in a specific situation and take measures to avoid repeating the same mistake.

How to Write an Effective Trade Note

For beginners to make the most of a trade note, it’s helpful to keep the following points in mind.

- Keep Records Simple: Avoid over‑detailing; concisely summarize necessary elements.

- Record Emotional Changes: Note emotions during trades, and refer to them when reviewing later.

- Review Regularly: By reviewing your trade note weekly or monthly, you can expect continuous growth.

For beginners, a trade note is not just a record of transactions but a valuable asset for personal growth. By using it appropriately, you can develop mental stability and reliable judgment while honing your sense as a trader.

2. Learn from Pro Traders! How to Write Effective Trade Notes

Trade notes are an essential tool for traders. What kind of information do pro traders include in their daily trade notes? By learning how to write them, you can create effective trade notes and improve your trading performance.

Recording Specific Details

Pro traders’ trade notes include the following specific details.

- Currency Pair: Specify the currency you traded.

- Entry Reason: Record your decision criteria for why you entered at that time.

- Order Type: Record the method used, such as market order or limit order.

- Exit Reason: Provide specific rationale for why you exited at that time.

- Result: Record the outcome and profit/loss.

Organizing and Recording Emotions

When writing a trade note, it’s important to record your emotions about the trade. Consider the following points when documenting.

- Positive Feelings: Reflect on how you felt about successful trades.

- Negative Feelings: If you had a losing trade or loss, write in detail how you felt at that time. This serves as material for reflection to avoid repeating the same mistakes.

Reflection and Improvements

Trade notes are not just records; they are tools to reflect on yourself. Based on trade results, let’s identify improvements such as the following.

Review Entry and Exit: – Analyze which conditions were favorable for successful trades. – For failed trades, consider at what point the decision was wrong.

Improve Trade Rules: – Review and clarify your trading criteria and rules to apply them in future trades.

Focus on Readability

One key point in creating effective trade notes is readability. Organizing a simple layout and essential items makes it easy to retrieve information when reviewing later. Using digital tools helps you take advantage of search functions.

By learning how pro traders write trade notes, even beginner traders can efficiently record trades and improve their trading skills.

3. Preventing Common Mistakes and Managing Mental Health with a Trade Journal!

Trading requires not only technical skills but also mental stability. For beginner traders, maintaining calm judgment can be difficult, and emotions can easily influence decisions. Here, we explain how to use a trade journal to prevent common mistakes and manage mental health.

Role of the Trade Journal

A trade journal is a valuable tool for reviewing past trades. Through the journal, you can achieve the following benefits.

- Organizing emotions: By recording emotions and thoughts during trades, you can clarify how you made decisions. This helps prevent being swayed by emotions.

- Analyzing failures: By recording your own mistakes, you can avoid repeating the same errors. Understanding the causes of failures and applying lessons to the next trade is essential.

Common Mistakes and Their Countermeasures

Below are mistakes that beginner traders often face and how to use a journal to prevent them.

Excessive lot size trading – Failure content: Trying to recover a previous loss by overtrading with large lots. – Countermeasure: In the trade journal, record the reason for setting the lot size and your emotions about it. Checking the rules is essential for calm judgment.

Emotion-driven decisions – Failure content: Losing calm judgment due to sudden news or market moves. – Countermeasure: By writing down the strategy and conditions decided before trading, you can trade without being swayed by emotions. Reviewing the notes helps reaffirm the criteria.

Insufficient post-trade reflection – Failure content: Often moving on without reviewing after a trade. – Countermeasure: Summarize your decisions and results in the journal for each trade to clarify areas for improvement. This becomes valuable learning material for the next trade.

Recording for Mental Management

To maintain mental stability, keep the following points in mind when using your journal.

- Recording successful experiences: Write detailed notes on winning trades to visualize success. This builds confidence for the next trade.

- Stress release: Writing down stress and anxiety felt during trading helps organize emotions and reduce psychological burden.

A trade journal is not just a recording tool; it’s an essential partner for self-reflection and skill enhancement. By understanding yourself through records and aligning your mental state, you can achieve success in trading.

4. Easy to Continue! How to Create Trade Notes Using Digital Tools

To make trade notes easier to maintain, using digital tools is highly effective. In particular, by using apps or web services that can be accessed easily from smartphones or PCs, you can reduce the burden of recording and manage your notes efficiently.

Benefits of Digital Tools

Here are some of the main benefits you can gain by using digital tools.

- Time savings: Compared to handwritten notes, digital notes can be entered with just a few taps. Especially with apps that provide selectable items, you can input information even faster.

- Search functionality: You can easily search past trade data, making it easier to review past performance. This allows you to quickly find specific trades or patterns.

- Data visualization: By displaying trade results in beautiful graphs and charts, you can get an instant overview of your performance. This can also boost your motivation.

Recommended Digital Tools

There are many digital tools available, but the following are particularly useful for creating trade notes.

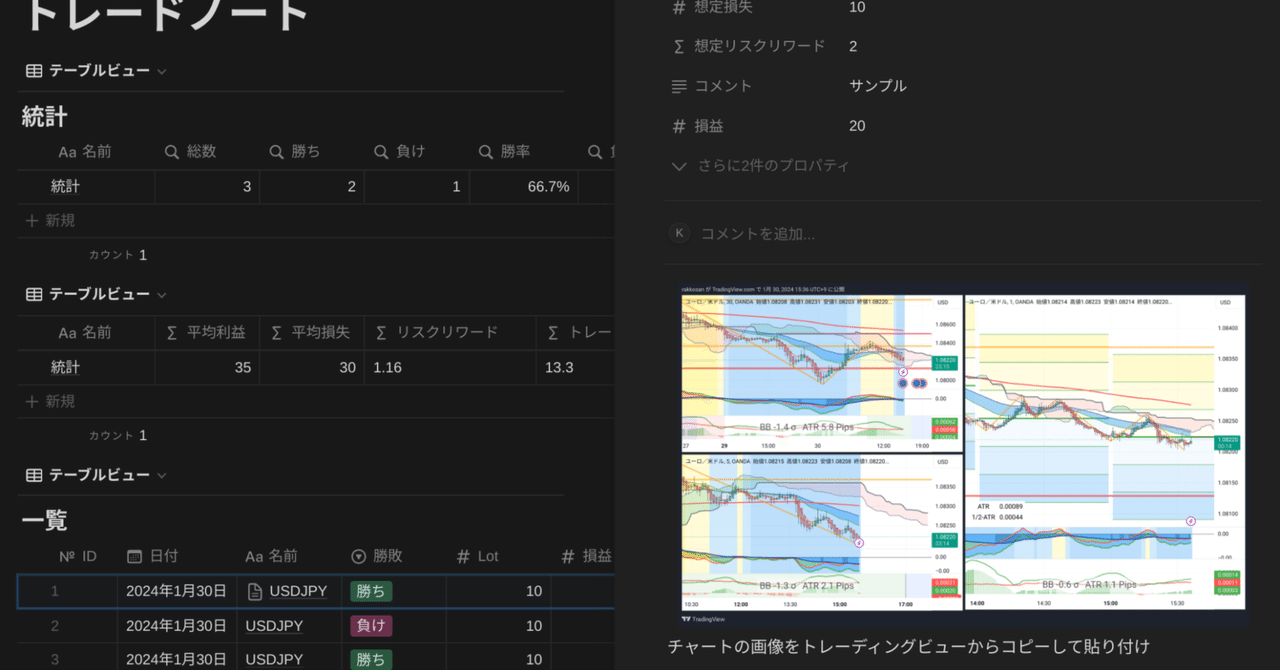

- Notion: A note-taking tool with a hierarchical structure that lets you organize and record trade details by category. Its flexible layout is a major attraction.

- Excel/Google Sheets: Customizable spreadsheets are great for detailed data management and aggregation. Calculating trade profits and losses is also simple.

- TradeNote: A trade-specific app that lets you easily enter daily trade results, with the feature of reflecting them in beautiful graphs.

Tips for Efficient Note Creation

Here are some points to keep in mind when using digital tools.

- Keep it simple: Narrow your input fields to essential information and make it easy to enter. For example, record the reason for entry, the basis for exit, and your feelings—keeping only the minimum necessary information is key.

- Regular review: By regularly revisiting your trade notes and conducting self-analysis, you can gain insights that can be applied to your next trade.

- Leverage feedback: By linking with social media such as Twitter and sharing your trade note results, you can also receive advice from other traders, which is effective.

By mastering digital tools, you can make trade notes easier to maintain and create an environment that leads to skill improvement. This will allow you to take the first step toward success in trading.

5. Visualizing Trading Performance and Skill Improvement Using Trade Notes

One of the biggest advantages of using a trade note is that you can understand your trading performance visually. By keeping trade records and displaying that data on charts and graphs, you can grasp your performance at a glance.

Visualization of Trading Performance

One of the biggest advantages of using a trade note is that you can understand your trading performance visually. By keeping trade records and displaying that data on charts and graphs, you can grasp your performance at a glance.

Graphing Daily Results

By entering the amount of assets gained or trade results after each trade, it will automatically be graphically displayed, visualizing the trend of your performance. This allows you to easily confirm upward or downward trends and helps you grasp your trading patterns.Monthly and Annual Trading Performance

In a trade note, you can review performance by month and also view results on an annual basis. This makes it easier to revise trading strategies according to seasonality and market fluctuations.

Feedback for Skill Improvement

Another important feature of a trade note is that it provides feedback to improve your skills. Let’s aim for skill improvement using the note with the following methods.

Reviewing Successes and Failures

It is important to review the trades you succeeded in and those you failed. By carefully recording the reasons for success and causes of failure, you can apply them to future trades. Check the following points: – Under what conditions did you succeed? – What should you improve when you fail?Analyzing Reasons for Entry and Exit

Clarifying the rationale for when you entered and exited improves the quality of future trades. This analysis allows you to refine your strategy.Recording Mental Management

By recording your mental state during trades, you can understand your mental strengths and weaknesses. This information will have a significant impact on future trading style and risk management.

Efficiency Through Digital Tool Utilization

Recently, many tools have emerged that manage trade notes digitally. This allows input tasks to be performed quickly and efficiently. In particular, the following points stand out.

Ease of Use

Many digital tools allow one-touch input and intuitive operation. This makes it easier to keep daily records without hassle.Robust Data Analysis Features

Digital notes may automatically aggregate and analyze data, providing performance evaluation from a professional perspective. This helps maximize the effectiveness of trades.

By focusing on these points when visualizing trading performance and improving skills with a trade note, you can expect dramatic growth compared to regular trading. Continuously reviewing and improving your own trades is essential.

Summary

Trade notes are an essential tool for beginner traders. By accumulating trade records, you can deepen self‑understanding and prevent emotional decision‑making. Additionally, leveraging digital tools enables efficient recording and analysis. Using trade notes to understand your trading style and improve your skills can be a shortcut to achieving stable performance. Beginners should refer to this article and learn effective ways to use trade notes.

Frequently Asked Questions

What is the importance of a trade note?

A trade note is an essential tool for a trader’s growth. It helps not only with recording trade history but also with emotion management and self‑analysis, leading to more effective trade strategy development. For beginners in particular, it is a valuable way to understand one’s tendencies and identify challenges.

What specific content should be recorded in a trade note?

A professional trader’s note includes specific details such as the currency pair traded, the reasons for entry and exit, the order method, and the results. Recording changes in emotions during the trade also clarifies mental challenges. Organizing this information helps improve one’s trade style.

Any tips for keeping a trade note?

To make it easier to keep a trade note, using digital tools is effective. Apps or web services that can be accessed easily from a smartphone or PC reduce the effort of input and allow efficient data management. Regular review and sharing feedback with other traders also help maintain motivation.

How can a trade note be used to improve skills?

A trade note includes features to visualize and analyze your trading performance. Graphing daily results and reviewing monthly or yearly performance lets you understand your trade patterns and weaknesses. Analyzing the factors behind successes and failures can also lead to more effective entry and exit timing.

Reference Sites

多くのプロトレーダーはトレードのたびにマメに記録をつけていると、株式会社ソーシャルインベストメントの清水一喜氏はいいます…

こんにちは、rakkosanです。 トレードノートはつけていますか? rakkosanも紙のノートやスプレッドシートに…