Today, there are several currencies in the world whose value has dropped dramatically. In this blog, we will delve into the ranking of the cheapest currencies and the economic and political factors behind them. We also introduce tips for travelers on foreign exchange and points to consider when choosing a currency for foreign currency deposits. Let’s deepen our understanding of inexpensive currencies and their impact from a broad perspective.

1. World’s Cheapest Currency Ranking

The value of currencies around the world fluctuates due to economic conditions and political influences. In particular, countries with low currency values often suffer from economic instability. Below, we introduce the current ranking of the cheapest currencies.

1.1 Rank 1: Venezuelan Sovereign Bolívar

The Venezuelan sovereign bolívar, the country’s currency, has been affected by economic crises for years, causing its value to plummet dramatically. With hyperinflation ongoing, many citizens commonly use foreign currencies, especially the U.S. dollar.

1.2 Rank 2: Iranian Rial

The Iranian rial has also seen its value sharply decline due to harsh economic sanctions and internal political issues. Since the Lehman Shock, the rial’s value has continued to fall, and many citizens are encouraged to use the dollar in everyday life.

1.3 Rank 3: Vietnamese Dong

The Vietnamese dong is relatively low in value compared to other cryptocurrencies and foreign currencies. While the Vietnamese government implements various measures to promote economic growth, the dong’s value remains comparatively low.

1.4 Rank 4: Georgian Lari

The Georgian lari is also known as a cheap currency. While the national economy is gradually stabilizing, the currency’s valuation remains low. This amount is influenced by both domestic and international factors.

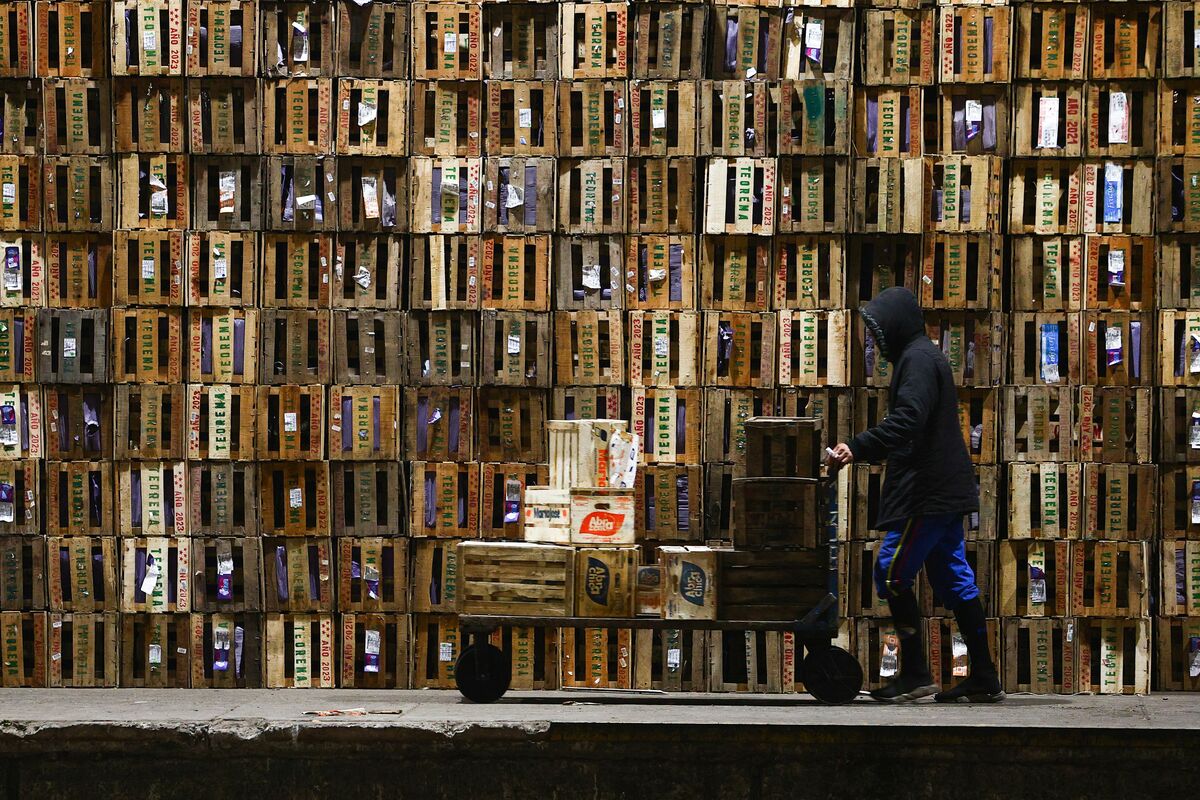

1.5 Rank 5: Argentine Peso

The Argentine peso has been affected by repeated economic crises and inflation, making it one of the world’s cheapest currencies internationally. Government economic policies also have a significant impact, and the peso’s value is particularly unstable.

These currencies are inexpensive even when viewed from the perspective of nominal effective exchange rates, and their weakness stands out in the global economy. Because currency conditions constantly change, it is important to stay updated with the latest information.

2. Causes and Background of Cheap Currency

Domestic Economic Slowdown

Behind cheap currency, in many cases, there is a deterioration of the country’s economic conditions. The slowdown in the economy reduces domestic production and consumption, ultimately leading to a decline in the currency’s value. In particular, in countries where the economy is not growing, recent recessions have accelerated the depreciation of the currency’s value.

Impact of Inflation

Rising inflation is also a major factor that pressures the currency’s value. As prices rise, real purchasing power falls, and citizens must pay larger amounts when using the currency. This undermines confidence in holding the currency, resulting in a lower valuation of the currency.

Political Instability

Political instability is also a major factor. When government policies are unstable and citizens or foreign investors lose confidence, the currency can be sold rapidly. For example, if political conflicts or unclear economic policies persist, foreign investment declines and the currency tends to depreciate.

Fiscal Deficits and Government Bonds

When a country runs a large fiscal deficit, its currency is hit directly. As national debt rises, investor confidence weakens and the currency is generally valued lower. In particular, if a downgrade of government bonds is announced, the impact becomes pronounced.

Other Factors

Finally, other factors must also be considered. For example, declines in commodity prices, changes in the global economic environment, and price drops in countries heavily dependent on natural resources.

Taken together, it becomes clear that cheap currency is not just an economic indicator but is closely linked to political and social factors. The depreciation of currency value is the result of many of these factors intertwining in complex ways.

3. Decline in the Value of the Venezuelan Sovereign Bolivar

Past Economic Conditions

The Venezuelan Sovereign Bolivar has recently suffered an extremely severe decline in currency value. This phenomenon is caused by the domestic economic crisis, and particularly hyperinflation is a key factor. The purchasing power of citizens has sharply decreased, making it difficult to access necessary goods and services. In fact, one US dollar is equivalent to several million bolivars, so even everyday transactions require enormous amounts, normalizing an abnormal situation.

Causes of Inflation

The causes of inflation are varied, but the main factors include the following circumstances:

- Political instability: The domestic political situation is unstable and constantly fluctuating. This deters foreign investment and further worsens economic growth.

- Economic policy failures: Inappropriate policy decisions by the central bank further reduce the currency’s value. In particular, excessive money supply accelerates inflation.

- Decline in commodity prices: Venezuela has an oil-dependent economy, and the drop in crude oil prices directly impacts it. This worsens the trade balance and leads to a vicious cycle of currency depreciation.

Implementation of Denomination

In 2018, a currency denomination was implemented. This measure meant switching from 10,000 old bolivars to 1 new bolivar. However, this denomination did not fundamentally improve the currency’s value and instead eroded public trust. The newly issued bolivars also gradually lost value due to inflation.

Current Situation

Today, the Venezuelan Sovereign Bolivar is known as one of the world’s least valuable currencies. Its value is highly unstable against the foreign currency, the US dollar, and citizens commonly use dollars in daily life. Additionally, soaring prices make it difficult to meet basic needs such as food and medical services, leaving citizens facing severe hardships.

4. Currency Exchange Tips for Travelers

When planning an overseas trip, currency exchange is a very important process. By carefully choosing the method and timing of exchange, you can reduce fees and obtain local currency at an ideal rate. Below are points that are useful for travelers.

1. Research Exchange Rates in Advance

Before you start your trip, it’s important to research the destination’s currency rates in advance. By checking exchange information online and comparing fees at various locations, you can find the best option. In particular, knowing the fees at local exchange offices and ATMs will allow you to transact with confidence.

2. Keep Cash to a Minimum

Carrying large amounts of cash increases the risk of loss or theft, so it’s wise to prepare only the amount you need. Using local ATMs allows you to withdraw just what you need, reducing risk. Additionally, using a debit card can help lower foreign exchange fees.

3. Choose a Reputable Exchange Location

When exchanging money, it’s important to choose a reliable location. Official banks and licensed exchange offices provide services that allow users to transact with confidence. Conversely, unofficial exchange offices in tourist areas carry risks of fraud and high fees, so it’s wise to avoid them.

4. Consider the Timing of Your Exchange

The timing of your currency exchange is also important. If you exchange before leaving Japan, choosing a time when rates are favorable allows you to exchange under advantageous conditions. Additionally, after arriving locally, preparing cash in line with your travel schedule helps you pay for transportation and meals smoothly.

5. Prepare Small Amounts of Cash

At airports and travel destinations, you often need more cash than you expect. Using taxis, public transit, or paying for street food can be problematic without cash. Having small change ready in advance allows you to handle unexpected expenses flexibly.

6. Verify Fees

Fees vary by exchange location, so it’s important to check them in advance. In particular, exchanging at banks or airports often incurs higher fees, but using specialized foreign exchange shops or voucher shops can offer better rates. Also, when using ATMs, fees differ, so be sure to carefully consider which ATM to use.

By taking these factors into account, you can avoid unnecessary expenses from currency exchanges before, during, and after your trip, and enjoy a more fulfilling travel experience.

5. How to Choose Currency for Foreign Currency Deposits

When making foreign currency deposits, how you choose the currency is a very important point in asset management. The chosen currency can greatly affect the investment outcome, so it needs to be considered carefully. Below, we explain the main factors to consider when selecting a currency.

Understand Currency Characteristics

First, understanding each currency’s characteristics is fundamental. Below are the characteristics of representative currencies.

US Dollar

- Widely traded as the world’s reserve currency, with high liquidity.

- Currency fluctuations are relatively stable, and there is abundant related information.

- It is important to keep an eye on US economic indicators and the central bank’s monetary policy.

Euro

- The currency adopted by the European Union, considered the second reserve currency.

- It is especially susceptible to German economic indicators, and political risks must also be considered.

British Pound

- A currency that has attracted attention due to Brexit, with a moderate trading volume.

- Because currency fluctuations are large, thorough risk management is required.

Australian Dollar

- A currency of a resource-rich country, sensitive to international commodity price fluctuations.

- Because it is highly correlated with the Chinese economy, attention to China’s economic trends is essential.

New Zealand Dollar

- A major exporter of agricultural products, often moving similarly to the Australian dollar.

- Trading volume is lower than that of the US dollar or euro, but commodity market movements also influence it, so it should be closely monitored.

Consider Interest Rates

When making foreign currency deposits, the interest rate at the time of deposit is also an unavoidable factor. Generally, foreign currency time deposits offer higher interest rates, and conditions vary by financial institution, so it is important to compare multiple options and find the most favorable terms.

Check Past Trends

If you want to choose a stable currency, analyzing past exchange charts for trends can be helpful. This will assist in determining the appropriate purchase timing.

Refer to Investor Trends

Observing other investors’ actions is also beneficial. Recent data shows that the US dollar is popular. By being aware of market trends and updating your own investment strategy, you can expect to improve the efficiency of asset management.

The Importance of Risk Diversification

There are many ways to choose currencies, but diversifying investments across multiple currencies can reduce risk. Even if one currency is unstable, if other currencies remain stable, overall risk decreases. While paying attention to each currency, keep your assets safe and manage them.

Summary

There are countries in the world whose currency values fluctuate significantly due to economic and political conditions. As examples such as Venezuela, Iran, and Vietnam show, the depreciation of a currency has a complex background, involving not only economic indicators but also political instability and fiscal deficits, all intertwined. For travelers and asset managers, understanding these factors and grasping the characteristics of the local currency is extremely important. Moreover, safe management through risk diversification is indispensable. Since currency value fluctuations continue constantly, it is wise to always stay updated with the latest information and respond flexibly.

Frequently Asked Questions

Why are the world’s cheapest currencies economically unstable?

Economic deterioration, high inflation rates, political instability, and fiscal deficits are the main factors that cause the value of the world’s cheapest currencies to decline. These issues intertwine complexly, undermining the currency’s reliability. As a result, they fall into a vicious cycle of being avoided by domestic and foreign investors.

Why has the Venezuelan Sovereign Bolívar fallen so far in value?

The Venezuelan Sovereign Bolívar has suffered extreme depreciation mainly due to severe hyperinflation and political instability. Failures in government economic policy and falling oil prices, among other factors, have accelerated the currency’s decline. The 2018 redenomination did not provide a fundamental solution, and a severe economic crisis continues today.

What points should you pay attention to when exchanging foreign currency?

When exchanging foreign currency, it is important to research rates in advance and conduct the exchange at a reputable location. Keep cash to a minimum, and reduce foreign exchange fees by using ATMs or debit cards. Also, pay attention to the timing of the exchange and prepare small amounts of cash.

What are the key points when choosing a currency for foreign currency deposits?

When selecting a currency for foreign currency deposits, it is important to review the currency’s characteristics, interest rates, and past trends. It can also be helpful to consider investor sentiment. Additionally, diversifying across multiple currencies can reduce overall risk from a risk‑diversification perspective.

Reference Sites

経済産業研究所(RIETI)…

早いもので2024年も下半期に入った。2024年上半期を終えたところでの円の現在地を整理しておきたい。 結論から言えば…