- 1 1. What is MT4? Features of a platform suitable for automated trading

- 2 2. Understanding the Basics of MT4 Automated Trading Settings

- 3 3. Beginner’s Guide | MT4 Automated Trading Setup Preparation Steps

- 4 4. Complete Guide | MT4 Automated Trading Setup

- 5 5. Monitoring and Management | Tips After Setting MT4 Auto Trading

- 6 6. MT4 Automated Trading: Key Points You Must Know When Setting Up

- 7 7. Summary | Next Steps to Succeed with MT4 Automated Trading Settings

1. What is MT4? Features of a platform suitable for automated trading

MT4 (MetaTrader 4) is an FX trading platform beloved by traders worldwide, and its multifunctionality and ease of use make it especially popular. It is widely used by beginners to advanced traders, and its automated trading (EA) feature is particularly noteworthy. This section provides a detailed explanation of MT4’s basic features and why it is suitable for automated trading.

Basic Overview of MT4

MT4 is a trading platform developed by MetaQuotes Software, and it is particularly characterized by the following features.

- Chart Analysis Features: Advanced technical analysis using a variety of indicators is possible.

- Flexible Trading Environment: One-click orders and easy customization of trading conditions.

- Extensive Customizability: Scripts and Expert Advisors (EAs) can be introduced, allowing you to build a trading environment tailored to yourself.

These features make MT4 a platform that is evaluated as meeting a wide range of needs, from discretionary trading to automated trading.

Reasons Why It Is Suitable for Automated Trading

The reasons MT4 is suitable for automated trading include the following points:

- Utilizing Expert Advisors (EAs)

- MT4 allows for automation of trades using programs called EAs. EAs are designed to automatically execute trades when specific conditions are met, eliminating the need for traders to monitor the market 24/7.

- Backtesting Functionality

- There is a feature that allows you to verify the performance of an EA using historical market data in advance. This enables traders to start operations after confirming the effectiveness of their strategy.

- Many Compatible Brokers

- Because many FX brokers adopt MT4, users can choose a broker that fits their trading style.

- Global Community

- Because traders worldwide use it, sharing of EAs and indicators is active. This allows beginners to obtain tools that are easy to use.

Advantages and Disadvantages of MT4

Advantages

- A relatively user-friendly interface even for beginners.

- Tools specialized for automated trading and chart analysis are abundant.

- There is a wealth of free indicators and EAs available.

Disadvantages

- Advanced settings require a certain amount of learning.

- Some features may be inferior compared to competing products (such as MT5).

Summary

MT4 is a trading platform supported by a wide range of users from beginners to advanced traders. In particular, reasons it is suitable for automated trading include the flexibility of EAs, backtesting functionality, and abundant community resources. The next section will provide a more detailed explanation of the basics of automated trading using MT4.

2. Understanding the Basics of MT4 Automated Trading Settings

Automated trading is a powerful tool for streamlining trades, but to succeed, it’s essential to have a solid grasp of the fundamentals. This section explains the basic concepts of automated trading in MT4 and the key points you should know to achieve success.

What is Automated Trading (EA)?

An EA (Expert Advisor) is a program that enables automated trading on MT4. Based on programmed rules, it automatically performs the following actions.

- Analyze market conditions.

- Place orders when conditions are met.

- Automate take-profit and stop-loss processing.

By utilizing an EA, you can trade without being influenced by human emotions, enabling logical and consistent trading.

Basic Benefits of Automated Trading

By utilizing automated trading, you can enjoy the following benefits.

- Trade Efficiency

- Even when it’s difficult to monitor the market 24/7, the EA will trade automatically for you.

- Emotion Elimination

- By eliminating emotional decisions (fear or greed) in trading, and following the set rules, you can aim for stable results.

- Execution of Complex Strategies

- Enables advanced strategies that are difficult to execute manually, such as combining multiple indicators into signals.

Points to Be Cautious About

However, there are also cautions with automated trading. It’s important to understand the following in advance:

- Adapting to Market Volatility

- While EAs are designed based on historical data, they may not handle sudden market shifts (such as economic releases or geopolitical risks).

- Risk of Incorrect Settings

- Incorrectly setting EA parameters can lead to significant losses. Careful testing before setting is necessary.

- Continuous Monitoring

- Relying too much on automated trading can lead to significant losses if unexpected errors or stops occur. Continuous monitoring is required.

Three Key Points Supporting Automated Trading Success

- Choose a Reliable EA

- Whether free or paid, select an EA that is highly reliable and widely used by many users.

- Verify with Demo Trading

- Before starting real operations, always confirm the EA’s performance in demo trading and adjust settings accordingly.

- Appropriate Risk Management

- Set the amount of capital and leverage for each trade appropriately, and establish rules to minimize losses.

Summary

Automated trading (EA) streamlines trades and eliminates emotions, enabling stable trading. However, success requires proper settings and risk management. The next section will provide a detailed explanation of the necessary preparation steps to start automated trading on MT4.

3. Beginner’s Guide | MT4 Automated Trading Setup Preparation Steps

To start automated trading on MT4, several preliminary preparations are required. This section provides a detailed explanation from installing MT4, opening an FX account, to choosing and obtaining an EA. Understanding these thoroughly will allow you to start automated trading smoothly.

How to Install MT4

- Download from the official site or broker

- Download MT4 from the official MetaTrader website or the link provided by your FX broker.

- It is recommended to use the broker-specific MT4, as it may include broker-specific settings.

- Run the installation

- Run the downloaded installer and follow the on-screen instructions to complete the installation.

- Check the installation folder, and if the default settings are acceptable, proceed as is.

- Log in to your account

- After launching MT4, enter the login information (account ID, password, server name) provided by your broker to log in.

Steps to Open an FX Account

To engage in automated trading, you need an FX account to trade. The steps to open an account are summarized below:

- Select a trustworthy broker

- Choose a broker that supports automated trading. Brokers with low spreads and high execution speed are recommended.

- Register required information

- Access the account opening form on the broker’s official website and enter the required details (name, address, contact information, etc.).

- Submit identity verification documents

- Upload identity documents (driver’s license, passport, etc.) and proof of address (utility bill, etc.).

- Activate the account

- Once you receive a notification from the broker that the account has been opened, make the initial deposit using the specified method to enable trading.

How to Choose and Obtain an EA

To start automated trading, you need an EA (Expert Advisor). The following explains how to choose and obtain an EA.

How to Choose an EA

- Differences Between Free and Paid

- Free EAs: Many have simple features and are easy for beginners to try.

- Paid EAs: Many have advanced features and are suitable for long-term operation.

- Check Reviews

- Check reviews from other users on MT4 communities and forums, and choose a reliable EA.

- Select an EA that matches your strategy

- Choose an EA that fits your trading style, such as scalping, day trading, or swing trading.

How to Obtain an EA

・Official Marketplace

You can purchase or download EAs from the ‘Market’ tab within MT4.

・Third-Party Sites

MQL5: language of trade strategies built-in the MetaTrader 5…

・Create Your Own

If you want to program your own EA, you use the dedicated language MQL4.

After obtaining an EA, don’t jump straight into a live account; first verify its operation on a demo account. Through demo trading, verify the following:

- Whether the EA is functioning correctly.

- Whether it can achieve the expected returns.

- Whether there are any issues with the settings.

Summary

To start automated trading on MT4, you need to install MT4, open an FX account, and select and obtain the right EA. By thoroughly completing these preparations, you can start automated trading with confidence. The next section will explain the specific methods for setting up MT4 automated trading.

4. Complete Guide | MT4 Automated Trading Setup

To execute automated trading on MT4, you need to correctly install the EA (Expert Advisor) and configure it properly. This section provides a detailed step-by-step explanation of how to set up an EA in MT4.

How to Install an EA

- Prepare the EA file

- EA file formats are typically .ex4 or .mq4. Obtain them in advance and save them in an easily accessible location on your computer.

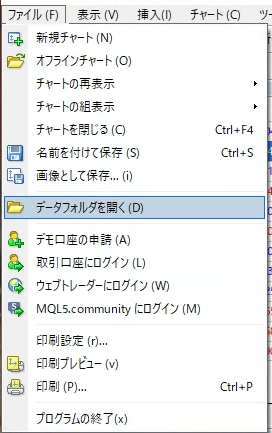

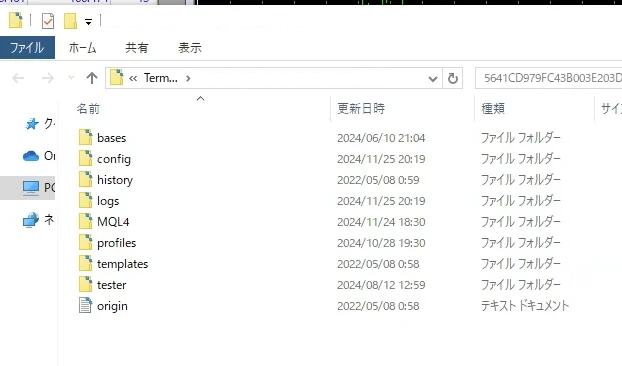

Open the MT4 Data Folder

- Launch MT4 and select File → Open Data Folder from the top menu.

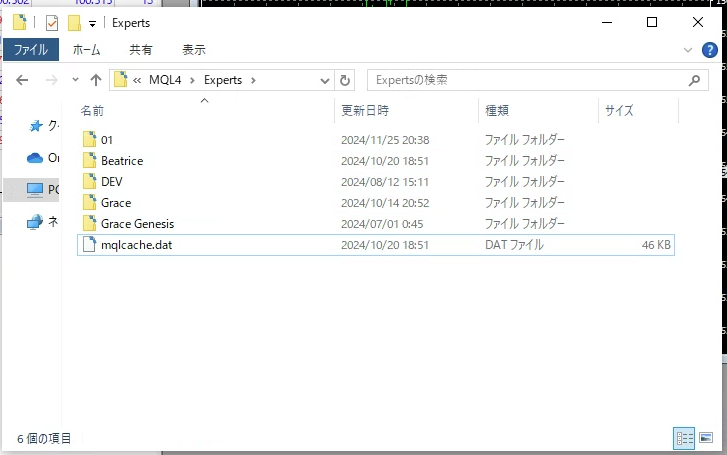

- Once the data folder opens, locate the ‘Experts’ folder inside the ‘MQL4’ folder.

Copy the EA File

- Copy and paste the EA file you prepared earlier into the ‘Experts’ folder.

- Restart MT4

- After placing the file, close MT4 and restart it. This will allow MT4 to recognize the EA.

- Verify the EA in the Navigator

- After restarting MT4, open the Navigator window on the left and confirm that the new EA appears in the ‘Expert Advisors’ section.

EA Settings and Parameter Adjustments

After installing the EA, properly configuring it will allow automated trading to proceed smoothly.

- Apply the EA to a Chart

- Drag and drop the EA you want to use from the Navigator window onto the chart of your chosen currency pair.

- Check the Settings Window

- When you place the EA on the chart, the settings window will appear. Let’s check the following items:

- General tab

- Check ‘Allow automated trading’.

- Check ‘Allow DLL imports’ if needed.

- Input Parameters tab

- Set parameters related to the EA’s operating conditions and risk management (e.g., lot size, stop loss, take profit, etc.).

- Save the Settings

- Once the settings are complete, click ‘OK’ in the lower right corner to save.

Enabling Automated Trading Steps

Even if the EA is correctly configured, it won’t operate unless automated trading is enabled. Please confirm activation using the following steps:

- Enable the Automated Trading button

- Click the ‘Auto Trading’ button at the top of MT4 and confirm that it turns green. This indicates activation.

- Check the smiley icon in the top right of the chart

- If the EA is operating correctly, a ‘:)’ smiley icon will appear in the top right of the chart.

- If a ‘:(‘ appears, you need to review the settings.

- Monitor Operation Status

- Check for signals on the chart and ensure there are no errors displayed in the ‘Experts’ tab of the Terminal window.

Performing Backtests (Optional)

Once the EA is configured, we recommend performing a ‘backtest’ to evaluate its performance using historical data.

- Open the Strategy Tester

- Click the ‘Strategy Tester’ tab at the bottom of MT4.

- Enter Test Settings

- Select the EA to use, the currency pair, and the timeframe (e.g., EUR/USD, H1).

- Set the test period (e.g., one year of past data).

- Start the Test

- Press the ‘Start’ button to begin the test.

- You can review the test results and performance in the ‘Results’ tab.

Summary

By accurately following the steps from installing the EA to configuring and enabling it, you can start automated trading smoothly. Additionally, by performing backtests to verify the EA’s performance beforehand, you can minimize risk. The next section will explain how to manage and effectively monitor a running EA.

5. Monitoring and Management | Tips After Setting MT4 Auto Trading

Once automated trading using an EA (Expert Advisor) starts running, the next important step is proper monitoring and management. Rather than leaving everything to the EA, the key to success is to respond appropriately to trading conditions and market changes. This section explains specific methods and precautions for managing an EA while it is running.

How to Check EA Operating Status

By regularly checking whether the EA is operating correctly, you can prevent problems before they occur.

- Check status on the chart

- Check the face icon (smile mark) displayed in the upper right corner of each chart.

- Smile mark (:) : EA is operating normally.

- Neutral mark (:|) : Automated trading may be disabled.

- Sad face mark (:( ) : A configuration error may have occurred.

- Check the ‘Experts’ tab in the terminal window

- The ‘Experts’ tab at the bottom of the MT4 screen records the EA’s activity logs and error information. Check the following information:

- Error code : Indicates configuration mistakes or server issues.

- Trade execution status : Details the trades and decision criteria performed by the EA.

- Check trade history

- In the ‘Account History’ tab of the terminal window, review the results of trades executed by the EA. Pay particular attention to the following:

- Profit and loss balance

- Abnormally high or low number of trades : Verify whether there is an issue with the settings.

Regular Parameter Adjustments

An EA operates according to pre-set conditions, but market conditions are constantly changing. By regularly adjusting parameters, you can maximize the EA’s performance.

- Understand changes in market environment

- Check whether the current market situation, such as a shift from a trending market to a ranging market, is suitable for the EA’s settings.

- Re-validate with backtesting

- Before changing settings in response to market changes, test the new settings with backtesting. Using a demo account can also be effective to reduce risk.

- Review risk management

- Adjust lot size, stop-loss width, take-profit width, etc., to optimize risk management.

How to Respond When Troubles Arise

If the EA is not functioning properly, it is important to respond quickly. Below are common troubles and their solutions.

- EA is not running

- Cause : The automated trading button is disabled, or the EA’s settings are incorrect.

- Solution : Enable the automated trading button and check that ‘Allow automated trading’ is checked in the settings screen.

- Error code is displayed

- Cause : EA configuration error, server error, or insufficient account funds.

- Solution : Check the error code and consult the MT4 official documentation or contact your broker.

- Performance is slow or stops

- Cause : Insufficient PC performance or internet connection issues.

- Solution : Use a VPS (Virtual Private Server) to stabilize the EA’s operating environment.

Using a VPS and Its Advantages

To run automated trading 24/7 reliably, using a VPS is recommended. A VPS allows the EA to run in an environment with uninterrupted internet connectivity.

Advantages

- Always on : The EA continues to run even if the PC is shut down.

- Fast connection : Low latency to the trading server, reducing slippage.

- Stability : Avoids risks of power outages or internet disconnections.

When choosing a VPS service, compare reliability, cost, and server response speed to make a selection.

Summary

To run an EA effectively, regular monitoring and adjusting settings according to market conditions are essential. Additionally, quick response is required when troubles arise. Using a VPS can secure a stable trading environment. The next section will provide a detailed explanation of the points to pay particular attention to when setting up MT4 auto trading.

6. MT4 Automated Trading: Key Points You Must Know When Setting Up

When operating automated trading on MT4, it’s essential to understand several key points not only to achieve efficient trading but also to avoid significant losses. This section provides a detailed explanation of the points to be mindful of before starting and during operation.

Reasons to Consider Using a VPS

To run automated trading continuously, MT4 must be running at all times. However, computer shutdowns or unstable internet connections can hinder trading. Therefore, using a VPS (Virtual Private Server) offers significant advantages.

- Ensure Trading Stability

- By using a VPS, you can run your EA continuously 24/7 without interruption.

- Improved Response Speed

- With a fast and stable internet connection, you reduce latency to the server, enabling trades to execute quickly.

- Cost Effectiveness

- VPS costs only a few thousand yen per month, but given the potential to prevent large losses and achieve stable profits, it offers high cost performance.

Impact of Market Holidays and Countermeasures

Days when the market is closed or specific time periods can affect EA operation.

- Trading Risks on Market Holidays

- When the EA runs during market holidays or low liquidity periods, spreads can widen significantly, increasing the risk of losses.

- Countermeasures

- Set the EA to temporarily pause during market holidays or when major events are approaching.

- Check the economic calendar in advance to be aware of important event dates.

Three Mistakes Beginners Should Avoid

By understanding the common mistakes beginners make in advance, you can avoid unnecessary losses.

- Lack of Risk Management

- Issue: Overly large lot sizes, no stop-loss set.

- Solution: Always set a stop-loss and ensure that no single trade exceeds 1-3% of your capital.

- Overconfidence in the EA

- Issue: Believing the EA is all‑capable and never checking its status after it starts.

- Solution: Regularly review the EA’s operation and adjust settings as needed.

- Overreliance on Historical Data

- Issue: Judging the EA solely on back‑test results without verifying real‑time performance.

- Solution: Verify real‑time performance on a demo account for a period before launching live trading.

The Importance of Troubleshooting

To be prepared if the EA does not operate correctly, make it a habit to check the following points.

- Check Error Messages

- Check the error details in MT4’s “Experts” tab.

- Re‑check Settings

- Verify that the EA is enabled and the automated trading button is active.

- Check Internet Connection

- Ensure there are no issues with the VPS or internet line.

Summary

MT4 automated trading setup requires preparation to stabilize trades and precautions to avoid risks. By utilizing a VPS, you can improve trading stability, and take measures such as pausing the EA during market holidays or low liquidity periods. Additionally, avoiding common beginner mistakes and responding quickly to problems can increase the chances of success.

7. Summary | Next Steps to Succeed with MT4 Automated Trading Settings

We have explained the knowledge necessary for MT4 automated trading settings from fundamentals to advanced applications. In this section, we will review what has been covered and outline concrete next steps to achieve success.

Review of Key Points Covered So Far

- Basics of MT4 and Overview of Automated Trading

- MT4 is a flexible and feature-rich trading platform, and using an EA (Expert Advisor) is essential to start automated trading.

- Points to Note During the Preparation Phase

- Installing MT4, selecting a reliable broker, and acquiring and testing an EA determine the success of automated trading.

- Proper Configuration and Operation of the EA

- By accurately following the steps from installing the EA to placing it on the chart and adjusting specific parameters, efficient operation becomes possible.

- Monitoring and Troubleshooting

- Regularly monitor the running EA and adjust settings in response to market changes and EA behavior.

- Points to Pay Attention To

- Using a VPS, managing risk, and avoiding common mistakes that beginners make are keys to success.

Next Steps to Succeed

Based on this knowledge, the following next steps are essential to achieve success with automated trading:

- Start with Demo Trading

- Before committing real funds, run the EA on a demo account to confirm stable performance.

- Clarify Your Trading Strategy

- Define a clear operating policy for the EA. Choose a market strategy that matches the EA’s characteristics, such as scalping or swing trading.

- Strictly Enforce Risk Management Rules

- Avoid risking more than 1–3% of your trading capital, and set lot sizes and stop losses carefully.

- Continuous Monitoring and Improvement

- Regularly review the performance of the running EA and adjust settings in response to market changes and EA behavior.

- Update Your Knowledge

- Success in automated trading requires continuous learning and staying abreast of market trends. Regularly gather information about new EAs, MT4 features, and trading strategies.

Action Plan for Implementation

Below is a concrete action plan based on what you learned in this article:

- Install MT4 and open a demo account.

- Select an appropriate EA, install it, and configure it.

- Test the EA in demo trading for 1–2 weeks and evaluate its performance.

- Set up a VPS to provide a 24/7 operational environment.

- Deploy a small amount of capital in a live account and start trading while managing risk.

Finally

Automated trading using MT4 is a powerful tool that enables efficient and stable trading. However, if preparation and management are insufficient, the risk of loss also exists. By applying the knowledge learned in this article and proceeding with caution, you can maximize profits while ensuring safe trading.

Take action now and step into the world of automated trading!