- 1 1. Introduction

- 2 2. What is the Strategy Tester?

- 3 3. Benefits of the MT4 Strategy Tester

- 4 4. MT4 Strategy Tester Setup Procedure

- 5 5. How to Use the Strategy Tester

- 6 6. How to Handle Errors

- 7 7. Practical Use Cases

- 8 8. FAQ (Frequently Asked Questions)

- 8.1 Q1: How can I improve the accuracy of backtests?

- 8.2 Q2: What causes the Strategy Tester to fail to run?

- 8.3 Q3: Visual mode is slow and lagging — what should I do?

- 8.4 Q4: I feel the Strategy Tester’s results are inaccurate — what could be the cause?

- 8.5 Q5: Can I directly apply Strategy Tester results to real trading?

- 9 9. Conclusion

- 10 Related Articles

1. Introduction

The Strategy Tester in MT4 (MetaTrader 4) is an extremely useful tool for traders. By using this tool, you can evaluate the performance of trading strategies and Expert Advisors (EAs) using historical price data. This article provides a detailed explanation of how to use the Strategy Tester and its setup procedures in a way that is easy for beginners to understand.

Using the Strategy Tester offers the following benefits:

- Testing trading strategies: You can try trading strategies using historical data without risking your capital.

- Evaluating EA performance: Test whether an EA is functioning properly and understand the expected profits and risks.

- Improving trading accuracy: Identify areas for improvement through backtesting and prepare for live trading.

This article comprehensively covers everything from the basics of the Strategy Tester to actual setup steps and solutions to common errors. It aims to provide useful information for beginners through intermediate users. By reading to the end, you’ll understand how to master MT4’s Strategy Tester and improve the accuracy of your trading strategies.

In the next section, we’ll take a closer look at what the Strategy Tester is.

2. What is the Strategy Tester?

The Strategy Tester in MT4 (MetaTrader 4) is a tool for evaluating the performance of trading strategies and Expert Advisors (EAs). Using this tool, you can run simulated trades on historical price data to verify a strategy’s effectiveness and performance.

Basic Functions of the Strategy Tester

The Strategy Tester mainly provides the following three functions.

- Backtesting

It verifies the behavior of EAs and indicators using historical price data. This allows you to confirm their effectiveness before applying them to live trading. - Forward testing

Run EAs or strategies in a simulated trading environment in real time to check how well predictions match actual results. - Optimization

The process of changing EA parameters to find the best settings. By testing multiple configurations, you can identify the combination that delivers the best performance.

Benefits of Using the Strategy Tester

By using the Strategy Tester, you can gain the following benefits:

- Risk reduction

You can test strategies in a virtual environment without putting real money at stake, minimizing risk. - Efficient strategy testing

You can replay historical data at high speed and test many scenarios in a short time. - Detailed result data

You can quantify trade performance with metrics like win rate, profit/loss, and drawdown (maximum decline in equity).

Why the Strategy Tester Is Important for Traders

What matters in trading is a planned approach and data-driven decision making. By using the Strategy Tester, you can clarify in which market conditions a trading strategy is effective and what risks may be hidden. This enables you to create trading plans logically without being swayed by emotions.

3. Benefits of the MT4 Strategy Tester

The MT4 (MetaTrader 4) Strategy Tester is a powerful tool that allows traders to validate and optimize their strategies and Expert Advisors (EAs). Below, we explain in detail the main benefits of using the Strategy Tester.

1. Backtesting Strategies Using Historical Data

Using the Strategy Tester, you can test trading strategies based on historical market data. This lets you reveal a strategy’s strengths and weaknesses without taking on real-time risk.

2. Evaluating Expert Advisor (EA) Performance

When considering implementing an EA, the Strategy Tester lets you see how the EA behaves under specific market conditions in advance. This helps you understand expected returns and potential risks and perform a thorough evaluation before deployment.

3. Strategy Optimization

The Strategy Tester helps you find the best combination of parameter settings by trying different configurations to maximize strategy performance. This can improve the precision and effectiveness of your trading strategies.

4. Simulating Real Market Conditions

The Strategy Tester simulates realistic market conditions by replaying historical market data. This allows traders to test strategies while recreating real market situations and obtain realistic feedback.

5. Cost and Time Savings

By validating strategies with the Strategy Tester before trying them in live trading, you can prevent unnecessary losses and save time and capital. This enables more efficient strategy development and improvement.

By leveraging these benefits, traders can effectively validate and refine their strategies to increase competitiveness in the market. The next section explains the specific setup steps for the MT4 Strategy Tester in detail.

4. MT4 Strategy Tester Setup Procedure

To use MT4’s Strategy Tester accurately and effectively, it’s important to configure it correctly beforehand. This section explains the basic setup steps for the Strategy Tester in detail.

4.1 Required Preparations

Preparing the Expert Advisor (EA)

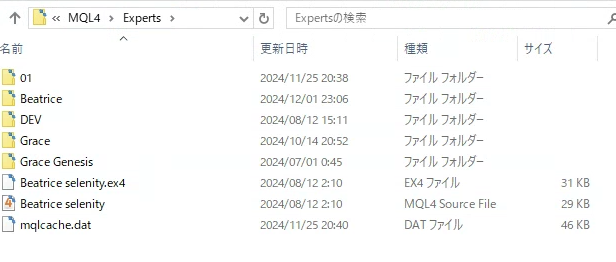

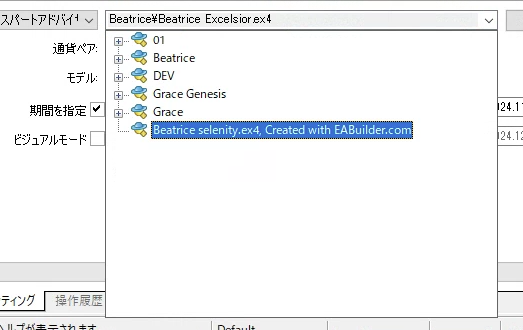

- Install the EA you want to test in MT4. The installation steps are as follows.

- Obtain the EA file (.ex4 or .mq4).

- From the MT4 menu, click “File” → “Open Data Folder”.

- Copy the EA file into the “Experts” folder inside the “MQL4” folder.

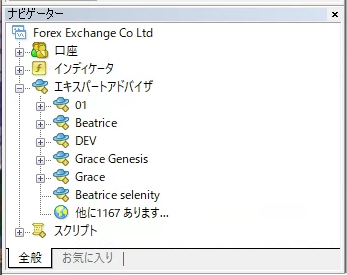

- Restart MT4 and check that the EA appears in the Navigator window.

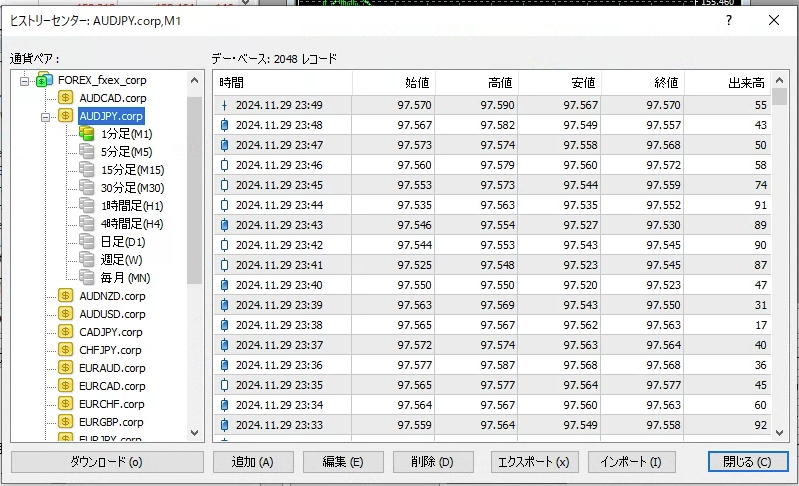

Checking and Downloading Historical Data

- Checking historical data

From MT4’s “Tools” → “History Center”, check the data for the currency pairs and periods needed for testing. If data is insufficient, backtest results may be affected.

- Downloading historical data

In addition to the default data, you can obtain accurate tick data by using tools such as Tick Data Suite. This enables realistic backtests and improves the accuracy of your verification. For detailed instructions, see the following article.

➡️ The Ultimate Forex Backtesting Tool “Tick Data Suite” – Accurate Verification with Real Tick Data

This article provides a detailed explanation of Tick Data Suite, a backtesting tool. Tick Data Suite is a unique tool th[…]

4.2 Basic Setup Flow

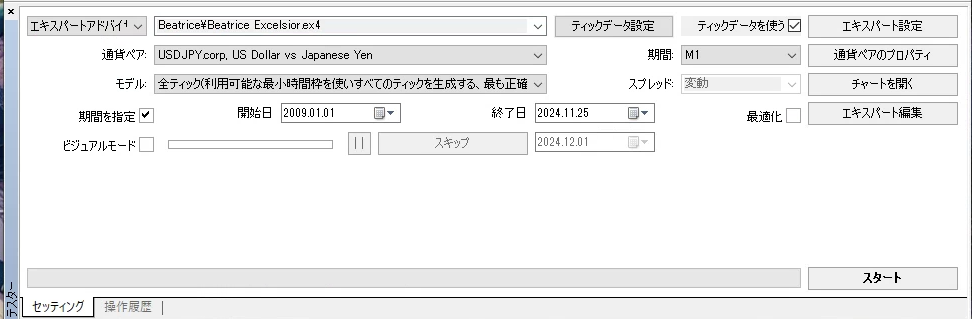

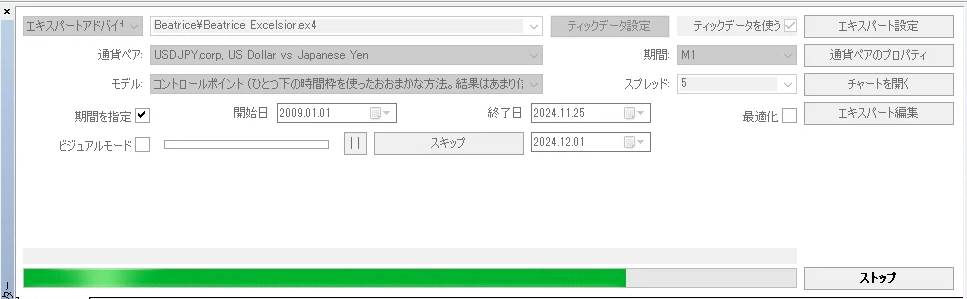

Launching the Strategy Tester

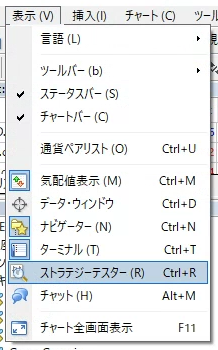

- From the MT4 menu bar, select “View” → “Strategy Tester”.

- The tester window will appear at the bottom of the screen.

Selecting EA and Indicators

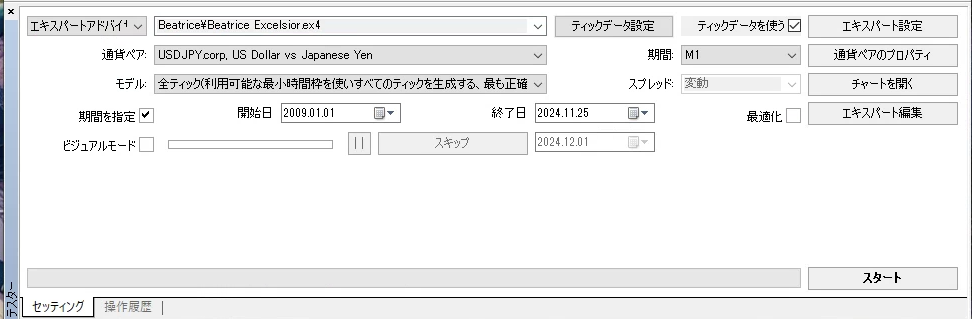

- In the tester window, choose the EA to use from the “Expert Advisor” dropdown.

Setting the Currency Pair and Timeframe

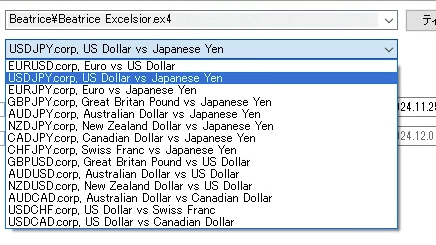

- Select the currency pair you want to test from the “Symbol” dropdown.

- Select the timeframe to test (e.g., 1-minute, 1-hour) from the “Period” dropdown.

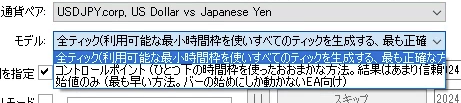

Choosing the Test Model

- In the “Model” options, choose one of the following three:

- Every tick: the most accurate model; reproduces all price movements.

- Control points: faster, but less accurate.

- Open prices only: calculated using each bar’s open price; the simplest and fastest.

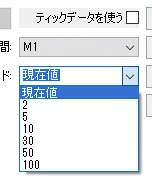

Spread and Date Settings

- You can choose the spread as “Current value” or enter a custom value.

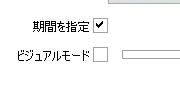

- In the “Dates” section, set the period to test (e.g., the past year).

4.3 Using Visual Mode

- To visually follow the chart movement, enable “Visual mode”.

- You can see how prices moved in real time during the test.

4.4 Review and Save Settings

- After finishing your settings, click the “Save” button to save them so future tests run smoothly.

5. How to Use the Strategy Tester

After finishing the basic settings in the Strategy Tester, proceed to run a test and check the results. This section provides a detailed explanation of how to use the Strategy Tester.

5.1 How to Start a Test

- Confirm settings

- Make sure all settings in the tester window (EA, currency pair, period, model, etc.) are correct.

- Enable Visual Mode if needed.

- Start the test

- Click the “Start” button on the right side of the tester window.

- The test will start, and progress will be shown with a bar.

- Check in Visual Mode (optional)

- If Visual Mode is enabled, the price chart will play back in real time so you can visually confirm the EA’s entries and exits.

- Adjusting the playback speed lets you closely observe specific moments as needed.

Note: test speed may decrease significantly.

5.2 How to Review Test Results

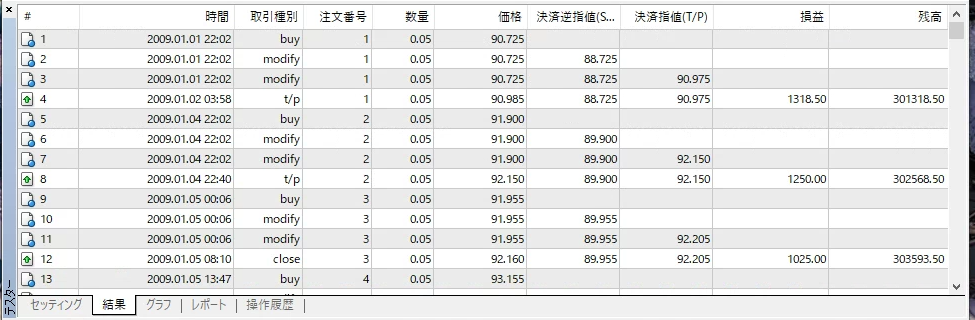

When the test is complete, you can view details in the “Results”, “Graph”, and “Report” tabs in the tester window.

Results Tab

- Detailed information for each trade (entry time, direction, price, profit/loss, etc.) is listed.

- Clicking a specific trade will highlight its position on the chart.

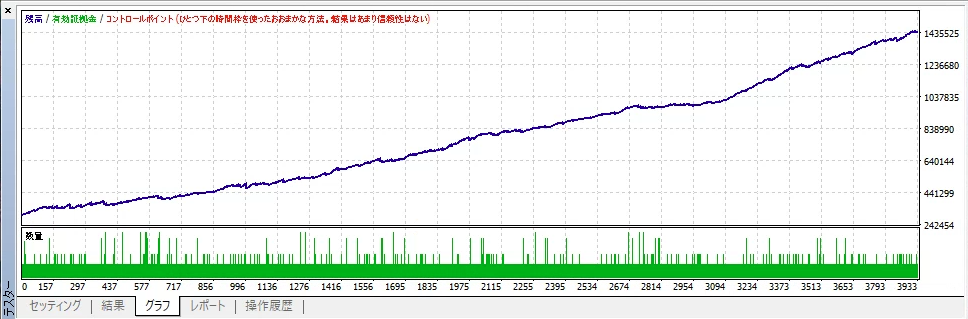

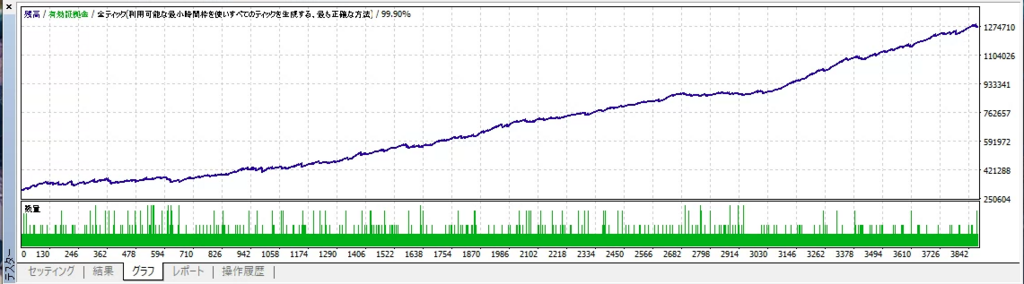

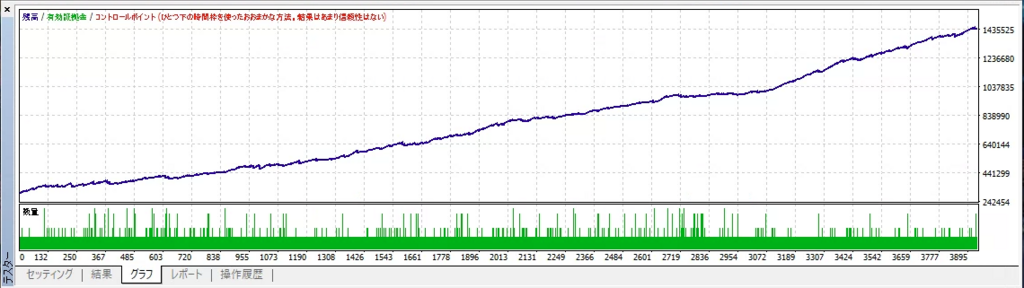

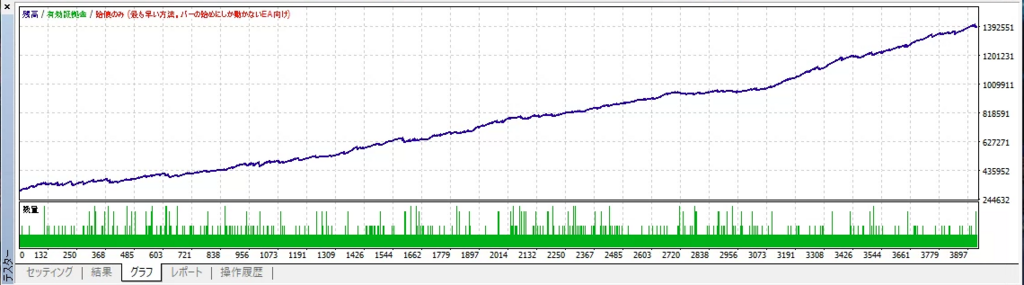

Graph Tab

- The graph displays the account balance over the test period.

- You can visually assess drawdowns and consistent profitability.

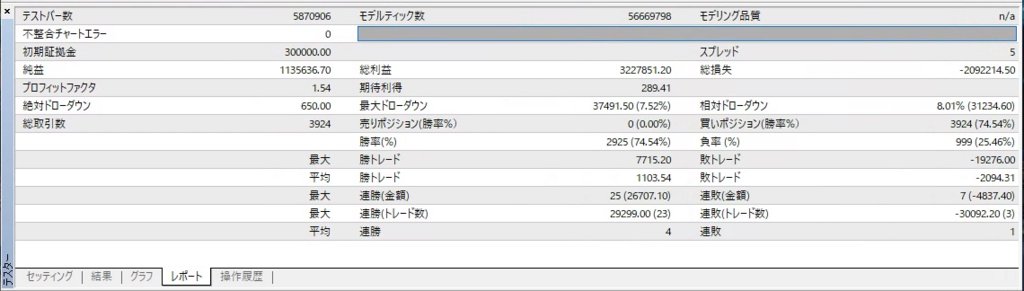

Report Tab

- Performance metrics for the entire test are displayed. The main items are as follows.

- Total Net Profit: the final profit or loss over the test period.

- Win Rate: the percentage of winning trades out of total trades.

- Profit Factor: the ratio of gross profit to gross loss. A value above 1 indicates a profit.

- Maximum Drawdown: the largest decrease in equity.

- Use these metrics to evaluate the effectiveness of the strategy.

5.3 Actions After Testing

- Improve the strategy

- Review the EA settings and strategy based on the test results.

- For example, if losses are large, make changes such as adjusting risk management parameters.

- Test across multiple time periods

- Test not only a single period but multiple different periods to confirm the strategy remains effective consistently.

- Test with other models

- It’s also important to test with different models, such as “Every tick”, “Control points”, and “Open price only”, and compare the results.

- Perform optimization

- If needed, use the optimization features explained in the next section to further improve performance.

6. How to Handle Errors

When using the Strategy Tester, errors can occur. These errors are mainly caused by misconfiguration or insufficient data, and knowing the appropriate countermeasures lets you resolve issues quickly. This section explains common error causes and their solutions in detail.

6.1 Common Errors and Causes

1. No Data for the Test Period

- Cause: This occurs when historical data for the specified period is insufficient.

- Solution:

- Open “Tools” → “History Center”.

- Select the currency pair and timeframe you want to use, then click the “Download” button to retrieve the data.

- If necessary, use external tools (e.g., Tick Data Suite) to add high-precision data.

This article provides a detailed explanation of Tick Data Suite, a backtesting tool. Tick Data Suite is a unique tool th[…]

2. EA Not Running

- Cause:

- There are errors in the EA’s code.

- The EA requires the use of DLLs (dynamic-link libraries), but they are not allowed.

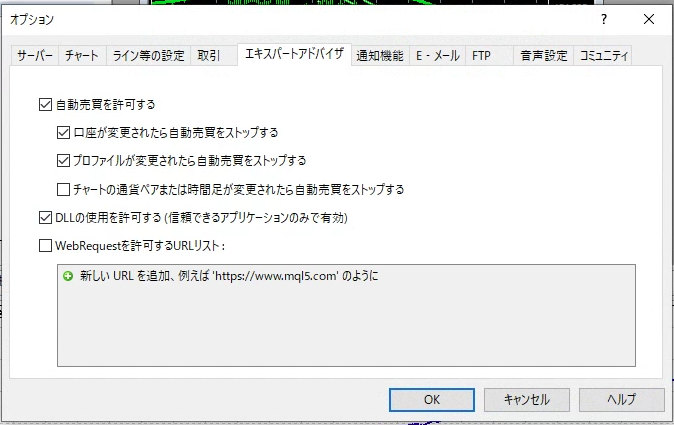

- Solution:

- Check the EA’s code for errors (open the .mq4 file in MetaEditor).

- Open “Tools” → “Options” → “Expert Advisors” tab and check “Allow DLL imports”.

3. Strategy Tester Stops

- Cause:

- Historical data is incomplete.

- The PC’s specs are insufficient.

- Solution:

- Recheck the data you’re using and download any missing parts.

- Close other applications to free up PC resources.

- Shorten the test period and run it again.

4. Inaccurate Results

- Cause:

- The selected model is inappropriate.

- The data is low quality.

- Solution:

- Set “Model” to “Every tick” and rerun the test.

- Use external tools to obtain high-precision data.

6.2 Troubleshooting Guide

Basic Checks When an Error Occurs

- Double-check your settings:

- Verify all Strategy Tester settings (currency pair, period, model, etc.).

- Check the logs:

- Check the “Journal” tab in the “Terminal” window to identify the error details.

Recommended Tools and Additional Settings

- High-precision data acquisition:

For high-quality backtests, we recommend obtaining historical data using external tools. Tick Data Suite is a representative tool for that.

This article provides a detailed explanation of Tick Data Suite, a backtesting tool. Tick Data Suite is a unique tool th[…]

- Performance optimization:

If your PC stops during testing, close unnecessary background applications to free up resources.

6.3 If the Problem Isn’t Resolved

- Contact EA support:

Contact the EA developer and ask them to help resolve the issue. - Ask on community forums:

It’s also effective to ask on forums used by many MT4 users (e.g., the MQL5 community) and learn from other traders’ experiences.

7. Practical Use Cases

To make the most of the MT4 Strategy Tester, it’s important to understand its effectiveness through concrete examples. This section explains, in detail and in an easy-to-understand way for beginners, practical uses ranging from simple examples to more advanced techniques.

7.1 Example: Verifying a Simple Trading Strategy

Strategy Overview

- Strategy name: EMA Crossover Strategy

- Objective: Test a simple trading strategy that enters a buy when the short-term exponential moving average (EMA) crosses above the long-term EMA, and enters a sell when it crosses below.

Steps

- Prepare EA or script

Prepare an EA that implements the EMA crossover strategy (many free EAs are available on the MQL5 Market and forums). - Strategy Tester settings

- Currency pair: EUR/USD

- Timeframe: 1-hour timeframe (H1)

- Test period: Past 1 year (e.g.: January 1, 2023 – December 31, 2023)

- Model: Every tick

- Run the backtest

- Start the test and check the Results and Graph tabs.

- Verify each entry/exit point is based on moving average crosses.

Analyze the Results

- Check metrics such as win rate, maximum drawdown, and profit factor in the Report tab.

- Also analyze how the strategy performs under different market conditions (e.g., during periods of high or low volatility).

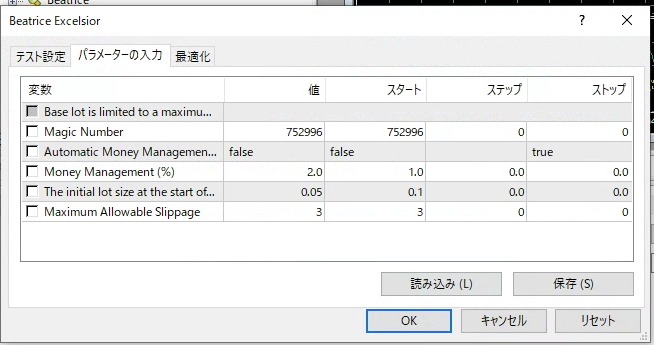

7.2 Example: Optimizing Advanced EA Settings

Strategy Overview

- Strategy name: Volatility-based trading using ATR (Average True Range)

- Objective: Optimize an EA that adjusts position size according to market volatility.

Steps

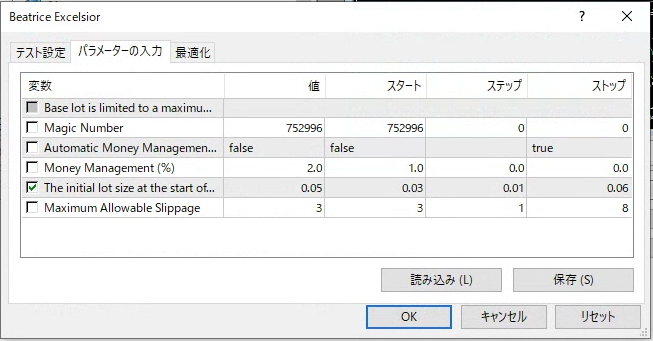

- Enable optimization mode in the Strategy Tester

- Check “Optimization” in the tester window.

- Set parameters

- Specify variables to test (e.g., ATR period, risk tolerance, stop-loss size).

- Set the range and step size for each variable.

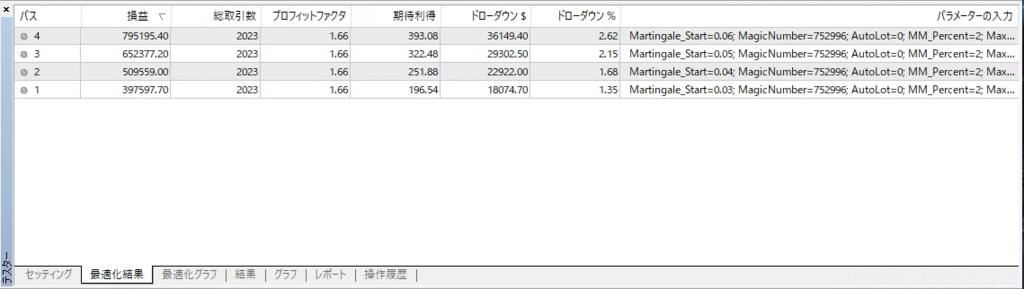

- Run the optimization

- Start the test and compare the performance of each setting from the “Optimization Results” in the Results tab.

- Choose the settings with the best profit factor and lowest maximum drawdown.

Analyze the Results

- Perform forward testing to confirm that parameters selected by optimization remain effective across other market conditions.

7.3 Trade Verification Using Visual Mode

Objective

- Use Visual Mode to directly observe EA behavior and indicator signals on the chart.

Steps

- Check “Visual Mode” in the tester window.

- Start the test and watch the chart playback.

- Verify that signal timing and entry/exit points match the strategy.

Benefits

- Visually understand aspects that are hard to see from results alone (e.g., sudden price spikes and the impact of spreads).

7.4 Applying to Live Trading

Based on Strategy Tester results, you can apply the following steps to live trading:

- Improve the strategy: Fix weaknesses identified in the test results.

- Risk management: Set risk tolerance based on maximum drawdown and risk/reward ratios.

- Implement in live trading: Run the validated EA on a real account (it’s recommended to test on a demo account first).

8. FAQ (Frequently Asked Questions)

This FAQ summarizes common questions traders have about using the MT4 Strategy Tester. It covers information useful for beginners through intermediate users.

Q1: How can I improve the accuracy of backtests?

A: To improve the accuracy of backtests, do the following:

- Use high-quality historical data:

Use external tools that can provide higher-precision data than MT4’s standard data (e.g., Tick Data Suite).

- Set the model to “Every tick”:

The “Every tick” model reproduces price movements most accurately, but be aware that it takes longer to calculate. - Adjust the spread:

Setting the spread used in tests to realistic values yields results closer to real trading conditions.

Q2: What causes the Strategy Tester to fail to run?

A: If the Strategy Tester doesn’t run, check the following points.

- Insufficient historical data:

Check data in the History Center and download any missing data. - Is the EA installed correctly?:

Make sure the EA file is placed in the correct folder (MQL4 > Experts) and restart MT4. - Is DLL usage allowed?:

Some EAs require the “Allow DLL imports” setting. You can change this under Tools → Options → Expert Advisors.

Q3: Visual mode is slow and lagging — what should I do?

A: If visual mode is slow, try the following improvements.

- Shorten the testing period:

If you’re using long-term data, shorten the test period and rerun. - Free up PC resources:

Close other applications to allocate sufficient CPU and memory to MT4. - Optimize graphics settings:

Remove unnecessary indicators and lines in MT4 chart settings to lighten the load.

Q4: I feel the Strategy Tester’s results are inaccurate — what could be the cause?

A: Possible causes for inaccurate results include the following.

- Using low-quality data:

MT4’s standard historical data may not accurately reflect spreads or price movements. - Inappropriate test model:

“Open prices only” or “control points” are simplifications and can be less accurate. - EA settings are incorrect:

Check that the EA parameters are set correctly.

Q5: Can I directly apply Strategy Tester results to real trading?

A: Avoid applying Strategy Tester results directly to real trading for the following reasons:

- Real-time market factors:

Backtests don’t account for real-time factors like slippage or changes in liquidity. - Psychological factors:

Psychological pressure can affect performance in real trading. - Importance of forward testing:

After backtesting, verify results with a demo account or forward testing to confirm behavior in real conditions.

9. Conclusion

The MT4 Strategy Tester is an essential tool for validating trading strategies and Expert Advisors (EAs) and for improving trading skills. In this article, we explained how to use the Strategy Tester, setup procedures, error-handling methods, and practical applications in a way that’s easy for beginners to understand.

Summary of key points

- Core features of the Strategy Tester

You can use backtesting and optimization with historical data, and Visual Mode, to examine the performance of strategies and EAs in detail. - Importance of settings

The choice of test model, the quality of historical data, and the selection of the testing period greatly affect the accuracy of backtests. - Practical use cases

From simple EMA crossover strategies to advanced parameter optimization, the Strategy Tester lets you validate a wide range of trading scenarios. - Handling errors

Knowing how to deal with common errors and issues in advance helps you run tests smoothly. - Applying to real trading

It’s important not to apply Strategy Tester results directly to live trading; instead, perform final verification through forward testing and demo accounts.

Next steps

When using the Strategy Tester to refine your trading strategies, try the following:

- Practice strict risk management

Check drawdowns and loss tolerance, and build strategies that minimize risk. - Conduct forward testing

Use a demo account to verify how a strategy that performed in backtests behaves in live market conditions. - Continuous improvement

Adjust strategies based on test results and develop flexible approaches that adapt to changing market conditions.

Finally

By using the Strategy Tester effectively, you can eliminate waste in your trading, manage risk more efficiently, and improve profitability. I hope this article helps you enhance your trading skills using the MT4 Strategy Tester.

As a next step, try applying what you’ve learned by actually using the Strategy Tester. Also, use other articles and resources to deepen your knowledge.

Related Articles

MQL4プログラミング記事…

MT4(メタトレーダー4)のストラテジーテスターを利用したEAのバックテストを行う方法について解説します。本記事では、M…