- 1 1. What are the benefits of building your own system trade?

- 2 2. Preparation Needed for Building Your Own System Trade

- 3 3. Detailed Steps for Building Your Own System Trade

- 4 4. Secrets to Succeeding with Custom System Trading

- 5 5. Risks and Countermeasures for Custom System Trading

- 6 6. Frequently Asked Questions (FAQ)

- 6.1 Is programming knowledge required to build a system trade yourself?

- 6.2 Are there any recommended platforms other than MetaTrader?

- 6.3 Why do losses occur in live trading even if backtesting results are good?

- 6.4 How often should a self-built system be maintained?

- 6.5 Is it possible to combine system trading with discretionary trading?

- 6.6 Are there free backtesting tools and resources available?

- 6.7 Summary

- 7 7. Summary

- 8 Reference Books

- 9 Reference Sites

1. What are the benefits of building your own system trade?

What is system trading?

System trading is a trading method that automatically executes trades based on pre-set rules. These rules include conditions for entries and exits (the timing of buying and selling). Unlike discretionary trading, it can be operated consistently without being influenced by emotions.

System trading primarily reduces the trader’s burden by automating trades using programs. In particular, using platforms like MetaTrader makes it relatively easy for beginners to get started.

Reasons to build your own system trade

The benefits of building your own system trade are diverse. Below we explain the main reasons.

Implement a strategy that’s uniquely yours

While commercially available automated trading tools and EAs (Expert Advisors) are convenient, they’re designed for everyone, so they may not fully match your trading style or goals. By building your own, you can embed a unique strategy based on your own trading rules and market understanding into the program.

Reduce costs

Purchasing commercially available system trading tools or EAs can be expensive. In contrast, building your own means the primary cost is the time and effort spent programming, which can reduce financial burden. In particular, using free platforms like MetaTrader lets you start while keeping initial investment low.

Gain flexibility and control

In a self-built system, you can change or optimize rules in real time. Even when market conditions shift, you can modify the code yourself, so you’re not bound by constraints like “waiting for updates” that come with commercial tools. Additionally, it’s easier to manage detailed trade data, giving you greater analytical freedom.

Beware of the drawbacks of building your own system trade

While there are many benefits, building your own also has some drawbacks. For instance, it may require programming skills, which can be a high hurdle for beginners. Additionally, there’s no guarantee that a self-built system will succeed, so thorough testing through backtests and live trading is required.

Summary

By building your own system trade, you can realize an original strategy and enjoy benefits in flexibility and cost. However, success requires skill and knowledge, and proper preparation and testing are essential. The next section will explain in detail the preparation needed to build your own system trade.

Reference sites

MetaTrader 5は、外国為替及び為替市場におけるテクニカル分析及び取引業務を行うトレーダー向けの無料アプリケーシ…

2. Preparation Needed for Building Your Own System Trade

Required Skills

To build your own system trade, a certain level of knowledge and skills is required. However, even first-timers can achieve it by learning the basics as they go. Here, we list the minimum required skills.

Basic Programming Knowledge

To build an automated trading system, you need to understand the basics of MQL (MetaQuotes Language), which is used in MetaTrader. Specifically, the following skills are helpful.

- Control flow using conditional statements (if) and loops (for, while)

- Variable declaration and data manipulation

- Function creation and invocation

With this knowledge, even a simple system can run effectively. Using online learning resources for programming beginners is also a good approach.

1. Introduction What is MQL Programming? MQL (MetaQuotes Language) is a dedicated programming language used in the Met[…]

Knowledge of Trading Strategies

The ability to build the underlying trading strategy for the program is required. This includes the following.

- Clarifying entry and exit conditions

- Basics of risk management (lot size, stop loss and take profit points)

- Strategy design based on understanding the differences between trend and range markets

Required Tools

To build your own system trade, having the right tools is essential. Below is a summary of the minimum required tools.

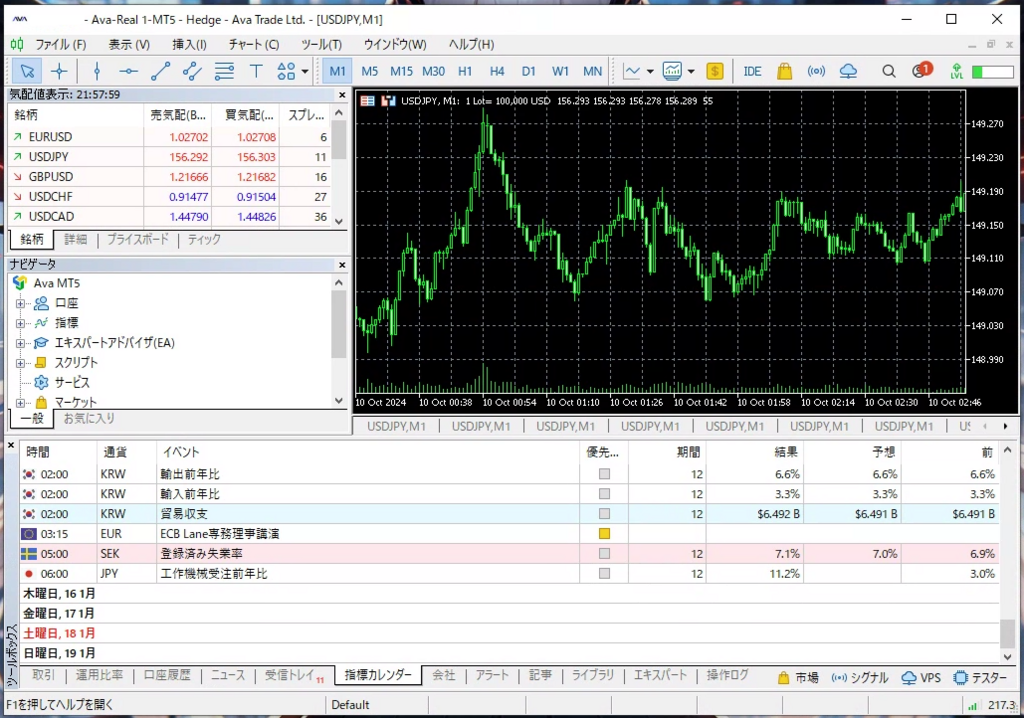

MetaTrader (MT4/MT5)

MetaTrader is a widely used trading platform worldwide and is ideal for building automated trading systems (EAs). It is free to use, making it accessible for beginners. Installation methods and basic operation can be found on the official site and beginner guides.

Data for Backtesting

To verify that your custom system works correctly, backtesting is necessary. Backtesting requires historical price data. MetaTrader has a feature to download historical data, which can be used for testing.

Code Editor

MetaEditor is the code editor that comes with MetaTrader and is suitable for creating EAs. With a simple interface, it is easy for beginners to use and is specialized for MQL development. It allows you to write code and fix errors consistently, making it convenient.

Initial Costs and Setup Effort

When building your own system trade, it is possible to keep initial costs low. However, you need to consider the following points.

Utilizing Free Resources

MetaTrader itself is free to use, and there are many free sample codes and learning resources available online. By utilizing these, you can learn without incurring costs.

Estimated Costs for Outsourcing

If you lack programming skills, hiring an expert to create the EA is an option. Outsourcing costs vary depending on the scope and complexity, but typically range from tens of thousands to hundreds of thousands of yen. Considering future modifications, you should pay attention to code readability and the presence of comments when outsourcing.

Summary

To build your own system trade, it is essential to prepare the minimum skills and tools. By acquiring knowledge of programming and trading strategies and utilizing free tools, beginners can start relatively easily. The next section will explain the specific steps for actually building a system trade.

3. Detailed Steps for Building Your Own System Trade

Step 1: Designing the Trading Strategy

The first step when building a system trade yourself is designing the trading strategy. Since this step forms the foundation of the entire system, it is important to plan carefully.

Set Clear Goals

- Profit Target: Clarify how much profit you aim to achieve monthly or annually.

- Risk Management: Set the acceptable loss per trade and target drawdown.

Define Entry and Exit Conditions

- Entry Conditions:

- Example: Buy entry when RSI is 30 or below, sell entry when RSI is 70 or above.

- Buy entry when price crosses above the moving average.

- Exit Conditions:

- Set fixed stop-loss and take-profit points (e.g., 10 pips stop-loss, 20 pips take-profit).

- Use a trailing stop to grow profits.

Choosing Timeframes and Target Markets

Decide on timeframes based on trading style—short-term (scalping), medium-term (day trading), long-term (swing trading). Also clarify the target markets such as currency pairs or commodity markets.

Step 2: Basics of Programming

Next, implement the trading strategy as a program. If creating an EA (Expert Advisor) for MetaTrader, follow these steps.

Programming with MetaEditor

MetaEditor is the dedicated code editor that comes with MetaTrader. To create a new EA, follow these steps:

- Create a new file:

Open MetaEditor and use the ‘Create New EA Wizard’ to generate the basic structure. - Define Entry Conditions:

In the OnTick function, code the entry conditions.

if (iRSI(NULL, 0, 14, PRICE_CLOSE, 0) < 30) {

OrderSend(Symbol(), OP_BUY, 0.1, Ask, 2, 0, 0, “Buy Order”, 0, 0, clrBlue);

} - Define Exit Conditions: Set take-profit and stop-loss conditions.

if (Bid >= TakeProfitLevel) {

OrderClose(ticket, lotSize, Bid, 2, clrRed);

}

Create a Simple EA for Testing

Initially, we recommend verifying operation with a simple logic rather than building a complex system. For example, create a basic system that uses a moving average crossover as a condition, and understand the basic operation.

Step 3: Backtesting and Optimization

To verify that the self-built system works as expected, perform backtesting.

Executing Backtests

- Select the strategy to test: Use MetaTrader’s ‘Strategy Tester’ to test the created EA.

- Use historical data: Use past data to check the system’s performance.

- Analyze results:

- Evaluate win rate, maximum drawdown, risk-reward ratio, etc.

- Calculate expected value (average profit – average loss).

Perform Optimization

Based on backtest results, adjust strategy parameters (e.g., RSI period or type of moving average) to improve performance. However, be careful of over-optimization. Over-optimizing on past data can result in poor performance in real-time trading.

Step 4: Live Operation

Finally, run the completed system in the real market.

Testing on Demo Trade

Before investing real money, conduct sufficient testing on a demo account. This reduces the risk of unexpected system behavior.

Transition to Real Trading

Once stable results are achieved on demo trading, start operating in a real account. However, keep the following points in mind:

- Start with a small amount of capital and observe the system’s behavior.

- Regularly monitor the system and adjust as needed.

Summary

Building a system trade yourself requires a series of processes from strategy design to programming, backtesting, and live operation. By carefully progressing through each step, you can build your own trading system.

4. Secrets to Succeeding with Custom System Trading

Case Studies of Success

Traders who have achieved success through custom system trading consistently practice several key elements. Below, we introduce specific examples and their success factors.

Case 1: Achieving Stable Profits with a Simple Strategy

One trader implemented a simple strategy based on a “moving‑average crossover” in an EA. This strategy emphasizes the following:

- Use the crossover of the long‑term moving average (50 days) and the short‑term moving average (10 days) as the entry condition.

- Set a fixed stop‑loss (10 pips) and take‑profit (20 pips).

- Operate specifically in trending markets.

Success Factors:

- The strategy is simple and avoids over‑optimization.

- Choose a strategy suited to the market environment (trending markets).

Case 2: Diversifying Risk with High‑Frequency Trading

Another trader created a scalping strategy that trades at high frequency. This strategy executes the following:

- Target short‑term price movements, completing trades in seconds to minutes.

- Limit the risk per trade to less than 1% of capital to minimize losses.

- Trade multiple currency pairs simultaneously to diversify risk.

Success Factors:

- Risk management is rigorous.

- Accumulate small profits through high‑frequency trading.

Key Points to Lead to Success

Emphasize Simple Strategies

Overly complex systems increase the risk of over‑optimization and may not perform well in real‑time markets. Many successful traders adopt simple strategies that stay true to the basics.

Implement Thorough Risk Management

In custom system trading, risk management holds the key to success. By rigorously applying the following, you can prevent large losses:

- Setting a Loss Tolerance: Limit the loss per trade to 1–2% of capital.

- Adjusting Lot Size: Choose an appropriate lot size based on capital.

Continuous Improvement and Adaptation

Market conditions are always changing. Therefore, successful system trading requires the following processes:

- Regular Performance Evaluation: Analyze the system’s trade results and identify issues.

- Updates: Adjust the system’s parameters in response to market changes.

Combining Backtesting and Forward Testing

Even if backtesting yields good results, that does not guarantee real‑time performance. Forward testing evaluates the system’s actual performance.

Key Points to Prevent Failure

Avoid Over‑Optimization

To achieve the best results in backtesting, over‑adjusting parameters can risk failing in real‑time trading. To prevent this, keep in mind the following:

- Set simple rules.

- Separate test data from unused data for validation.

Operate Without Being Driven by Emotion

The biggest advantage of automated trading is that it eliminates emotion. However, when a system temporarily incurs loss, traders may become emotional and make mistakes like stopping the system. Adhering to rules and operating with a long‑term perspective is essential.

Conclusion

To succeed in custom system trading, it is essential to design simple and solid strategies, enforce rigorous risk management, and continuously improve without neglecting adaptability to market changes. The next section will explain system trading risks and their countermeasures in detail.

5. Risks and Countermeasures for Custom System Trading

Main Risks in System Trading

While creating your own system trading, there are many benefits, but various risks also exist. Here we explain the main risks and their specific details.

1. Risk from Market Volatility

The market is constantly changing, and a strategy that worked in the past may not be valid in the future. In particular, the following factors can affect system performance.

- Large price swings due to economic indicators or policy changes.

- Slippage and order rejection caused by reduced liquidity.

- Emergence of new market trends.

2. Program Bugs and Errors

Custom systems may contain programming bugs or logic errors, which can lead to unintended trades.

- Stop-losses are not set correctly.

- Entry conditions trigger multiple times, causing unnecessary orders.

3. Risk from Over-Optimization

If you over-tune a system to achieve good backtest results, it may fail in real-time markets. This is called “overfitting.”

4. Technical Risks

Since system trading is fully automated, technical problems can cause the entire system to stop. For example:

- Internet connectivity issues.

- Server outages or platform downtime.

- Failure of the PC or VPS in use.

Specific Countermeasures for Risks

How to Respond to Market Volatility

- Operate multiple strategies

- By preparing multiple strategies tailored to specific market conditions, you can flexibly adapt to changes.

- Regular performance evaluation

- Analyze trade history regularly and adjust the system if performance declines.

- Control position size

- In highly volatile markets, set a smaller position size to reduce risk.

How to Prevent Program Errors

- Thoroughly test the system

- Repeat backtests and forward tests to minimize errors.

- Utilize error logs

- Implement logging in the program to record when errors occur.

- Use sample code

- For beginners, building on existing sample code can reduce errors.

How to Avoid Over-Optimization

- Adopt simple rules

- Avoid complex conditions and design concise, clear strategies.

- Split data testing

- During backtesting, reserve a portion of data for validation instead of using all data.

- Verify generalizability

- Test across different markets and timeframes to evaluate strategy generalizability.

Preparing for Technical Risks

- Use a stable VPS

- Using a high-quality VPS (virtual private server) keeps the system running at all times.

- Create backups

- Regularly save backups of the program and configuration files.

- Emergency response plan

- Prepare procedures in advance to quickly restore the system when it stops.

Conclusion

Custom system trading carries many risks, but by implementing countermeasures for each, you can minimize them. Anticipate various challenges such as market volatility, program errors, over-optimization, and technical issues, and strive to design a system that can adapt flexibly.

6. Frequently Asked Questions (FAQ)

Is programming knowledge required to build a system trade yourself?

Answer:

Yes, basic programming knowledge is required. When building a system in MetaTrader, you use a programming language called MQL (MetaQuotes Language). However, complex skills are unnecessary; understanding basic syntax such as conditional branching and loops is sufficient. Additionally, using sample code and templates allows beginners to learn smoothly.

Are there any recommended platforms other than MetaTrader?

Answer:

MetaTrader is a widely used platform, but the following options are also popular.

- cTrader: Simple and intuitive operation is possible, and strategies are developed using C#.

- NinjaTrader: Specialized in derivatives markets and futures trading, equipped with advanced analytical tools.

Each platform has its own characteristics, so it is recommended to choose one that matches your trading style and objectives.

Why do losses occur in live trading even if backtesting results are good?

Answer:

There can be gaps between backtesting results and live trading, such as:

- Slippage: In the real market, there can be a discrepancy between the order price and the execution price.

- Over-optimization: If you over-adjust the strategy to achieve good backtesting results, it may not work under actual market conditions.

- Real-time volatility: Sudden market movements that were not anticipated in backtesting can have an impact.

To prevent this, it is important to conduct forward testing and experiments in a demo account to confirm the system’s stability.

How often should a self-built system be maintained?

Answer:

It depends on the system’s operation and market conditions, but it is recommended to perform the following checks at least once a month.

- Analysis of trading results: Verify that the system is performing as expected.

- Reevaluation of market conditions: Consider whether the current market is suitable for the system.

- Bug fixing in the program: Check logs to ensure no errors have occurred.

Additionally, adjustments may be made before and after major economic events to prevent performance degradation.

Is it possible to combine system trading with discretionary trading?

Answer:

Yes, it is possible. An approach that uses system trading as a foundation while adding discretionary decisions at specific times is called a ‘hybrid strategy.’ This method offers the following advantages.

- Ensures stability and efficiency through automation.

- Allows flexible response to specific market fluctuations.

For example, there is an approach where the discretionary exit timing is adjusted only when the automated trading system meets the entry conditions.

Are there free backtesting tools and resources available?

Answer:

Yes, you can use the following free tools and resources.

- MetaTrader‘s Strategy Tester: Provides free backtesting functionality.

- Forex Tester (Free Version): Allows testing of systems using historical market data.

- TradingView: A web-based charting tool that visually tests strategies.

By using these, you can verify the system’s operation and identify areas for improvement.

Summary

This FAQ section answered frequently asked questions when building a system trade yourself. It introduced the necessary knowledge and tools in detail so that even beginners can proceed while resolving their doubts.

7. Summary

The Appeal of Building Your Own System Trade

By building your own system trade, traders can realize a unique trading strategy and aim for success in the market. The biggest appeal of a custom system is that it can solve the following points that are difficult in discretionary trading:

- Emotion‑free operation: Automation enables calm and consistent trading.

- Time savings: Reduces the burden of monitoring trades, making it compatible with everyday life.

- Unique strategy: You can design an original system tailored to the market.

Additionally, leveraging programming knowledge expands your trading range and provides flexibility to adapt to new strategies and market conditions.

Key Points to Succeed in Building Your Own

Based on the content covered so far, we summarize the key points that are the keys to success:

- Design a simple strategy

- Avoid overly complex rules and aim for a design that adapts easily to market conditions.

- Thoroughly conduct backtesting and forward testing

- Verify that the system performs as expected using historical data and real markets.

- Implement rigorous risk management

- Clearly set stop‑losses and lot sizes, prioritizing strategies that protect capital.

- Continuously improve

- Adapt to market changes and keep updating the system.

Next Steps

When you’re ready to build your own system trade, follow these steps:

- Clarify your strategy: Design basic rules based on your goals and trading style.

- Create the program: Use MetaTrader or other platforms to build a simple system.

- Test and adjust: Verify system performance with backtesting and demo trading, and improve as needed.

- Start live operation: Begin with a small amount in the real market and confirm system stability.

The Value of Building Your Own and the Significance of Taking on the Challenge

Building your own system trade requires learning and trial and error, but the process itself is a significant growth opportunity. The sense of achievement when your strategy produces results in the market is immense, and it can spark new possibilities in the world of trading.

Through this article, we hope you have learned everything from the basic knowledge needed for building your own system trade to practical steps. Please use this article as a reference and create your own system. Continuous effort paves the way to success!

Reference Books

Amazon.co.jp…

Reference Sites

<はじめに> このサイトはプログラミング言語MQL5で、MT5用のEA(自動売買プログラム:エキスパートアドバイザー)を…

プログラミング初心者の方が初めてでもEAを開発できるように解説したページです。このページの内容をマスターすれば…

Note: GlobalTradeCraft does not intend to promote overseas FX.