Island Reversal ni mojawapo ya viashiria muhimu zaidi kati ya mifumo ya chati. Makala hii ya blogi inatoa maelezo ya kina kuhusu Island Reversal, ikijumuisha mchakato wake wa kujengwa, ishara, na jinsi ya kutambua muda bora wa kununua na kuuza. Tutakuonyesha maarifa mbalimbali muhimu kusaidia kuelekea biashara, ikiwa ni pamoja na jinsi ya kutafsiri kwa usahihi harakati za soko na kukamata fursa. Je, uko tayari kupitia ulimwengu wa kina wa Island Reversal?

- 1 1. Je, Island Reversal ni nini?

- 2 2. Mchakato wa Kujenga Island Reversal

- 3 3. Island Reversal Signals

- 4 4. Trading During an Island Reversal

- 5 5. Jinsi ya Kutambua Alama za Mabadiliko ya Juu la Juu za Kushindwa (Mifumo)

- 6 Muhtasari

- 7 Frequently Asked Questions

- 7.1 What is the distinctive shape of an Island Reversal?

- 7.2 How does the Island Reversal formation process proceed?

- 7.3 Island Reversals have two patterns: “Island Top” and “Island Bottom.” What are their respective characteristics?

- 7.4 What are the key points for identifying false Island Reversal signals (traps)?

1. Je, Island Reversal ni nini?

Island Reversal ni viashiria vya kitekniki vinavyowasilisha muundo wa kipekee kwenye chati za soko la fedha. Muundo huu kwa kawaida unasisitiza mabadiliko ya mwelekeo, mara nyingi ukielezea mabadiliko kutoka kwenye uptrend hadi downtrend au uhai kutoka downtrend hadi uptrend.

Muundo wa Kipekee

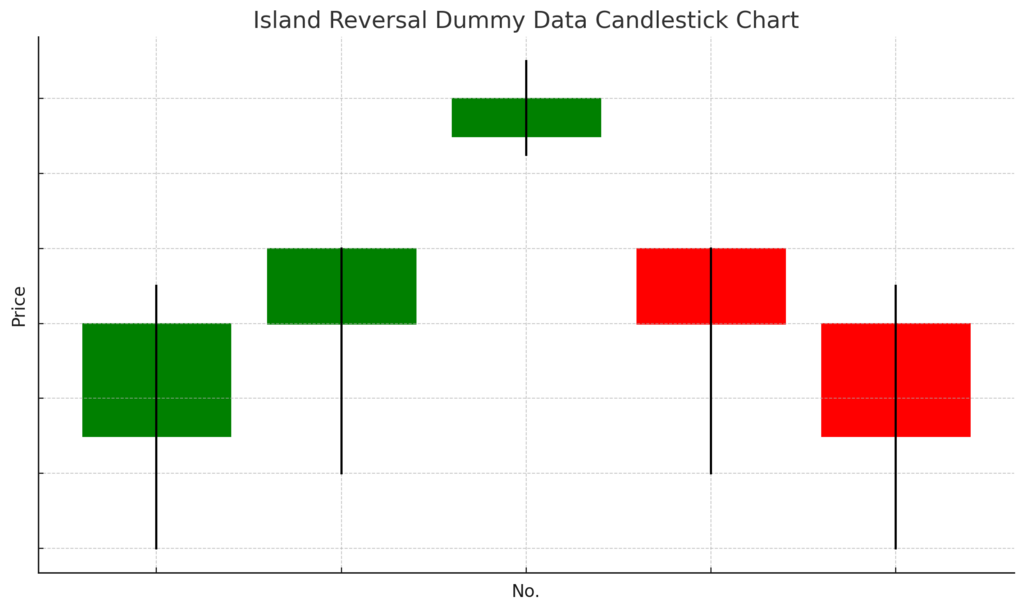

Island Reversal inatengenezwa kwa viwango viwili vinavyotokana pamoja gap. Gap ya kwanza inafunguliwa wakati wa mwelekeo unaoendelea, ikiwaleta bei ya soko kuongezeka au kupungua haraka. Baada yake, bei inabadilika, na kwa kufungua gap nyingine katika mwelekeo tofauti, inarudi kwenye kiwango cha awali cha bei, ikizalisha muundo wa “isolated island” kwenye chati. Muundo huu ni sifa kuu ya Island Reversal.

Umuhimu wa Gaps

Katika muundo huu, kiwango cha bei kilicho kati ya gap ya kwanza na ya pili kawaida kinahusika kama eneo la kupinga au kusaidia linalothibitishwa sana. Kwa husika, athari ya kiakili ya viwango hivi kwa washiriki wa soko ni kubwa, ikitathirisha kwa nguvu maamuzi ya kununua na kuuza ya wawekezaji.

Mchakato wa Kujenga

Jinsi ya kujenga Island Reversal kawaida inafanyika kama ifuatavyo:

- Katika uptrend, soko linapata ongezeko la haraka kwa kufungua gap ya juu, ikifuatiwa na mabadiliko ya muda mfupi.

- Baada ya hapo, inafungua gap ya chini, ikionyesha harakati ambapo bei inarudi kwenye kiwango chake cha awali.

Kwa hivyo, Island Reversal inaweza kujengwa kwa kengele moja ya kengele au kengele kadhaa, ikifanya muonekano wake wa chati wa kipekee kuwa kuvutia.

Athari ya Kiakili ya Wateja

Mwanzo wa kujenga Island Reversal ni mambo ya kiakili ya wawekezaji kuelekea soko. Kwa husika, wawekezaji walioweka maombi kwa faida kutokana na ongezeko la awali wana uwezekano zaidi wa kupata hasara zisizokamilika wakati wa mabadiliko ya baadaye. Hii ni kwa sababu wawekezaji wengi wana hasara wanaongeza shinikizo la kuuza, ambalo linaongeza zaidi kupungua kwa bei.

Maana ya Neno

Kwa moja kwa moja kutafsiriwa kuwa “jiji lililobadilishwa” kwa Kijapani, Island Reversal, kama jina lake linavyoonyesha, inahisi kama ishara muhimu inayoonyesha mabadiliko ya mwelekeo wa soko. Kuelewa muundo huu kunasaidia wawekezaji kutambua mabadiliko ya bei mapema na kuendeleza mikakati bora ya biashara.

2. Mchakato wa Kujenga Island Reversal

Island Reversal ni muundo wa chati unaojengwa chini ya hali maalum. Kuelewa muundo huu ni muhimu kwa kutambua mabadiliko ya soko. Juu ni maelezo ya kina ya mchakato wake wa kujenga.

2.1 Hatua ya Kwanza ya Kujenga: Gap ya Juu katika Uptrend

Island Reversal inaanza kwa gap ya juu inayofunguliwa katika uptrend. Wakati wa hatua hii, bei za hisa zinapanda kwa kasi, na matarajio ya wawekezaji yanazidi kukua wakati ongezeko unapendelea. Sifa ya kipekee wakati huu ni ongezeko la haraka la bei, hasa karibu na kiwango cha juu, ikivutia wawekezaji zaidi.

2.2 Hatua ya Pili ya Kujenga: Utongezeka wa Wateja Wenye Hamasa

Baada, jiji lililobadilishwa karibu na kiwango cha juu linatengenezwa wakati bei zinapanda. Katika hali hii, wawekezaji wapya wanauza na kununua, wakijaribu kusimama juu ya uptrend, na kusababisha bei kuongezeka kwa muda mfupi. Wateja katika hatua hii hajaridhika kununua bei za juu, ambayo itathirisha soko la baadaye kwa kiasi kikubwa.

2.3 Hatua ya Tatu ya Kujenga: Gap ya Chini Inayoonyesha Kupungua

Subsequently, prices fall sharply, and a downward gap appears. At this moment, investors who bought near the peak rush to sell, accelerating the downward movement. This marks a turning point in the market, signaling a transition from an uptrend to a downtrend.

2.3.1 Psychological Factors

At this stage, investors holding unrealized losses begin to feel psychological pressure, leading even more people to sell. This accelerates the decline and contributes to the establishment of the Island Reversal.

2.4 Final Stage of Formation: Market Reversal

Finally, with the formation of the Island Reversal, the market fully transitions from an uptrend to a downtrend. At this stage, new movements have already been observed for several days, and the entire market is ready to enter a strong downtrend.

Due to its shape, the Island Reversal forms a very strong resistance zone and effectively functions as a reversal signal. Investors are required to understand this to predict future trends and formulate appropriate strategies.

3. Island Reversal Signals

The Island Reversal provides very clear reversal signals on trading charts, making it crucial to understand them thoroughly. Specifically, there are two main forms of this signal: “Island Top” and “Island Bottom.”

Island Top and Island Bottom

- Island Top: This pattern forms when an upward gap first opens during an uptrend, immediately followed by a downward gap. When an Island Top appears, it is considered a sell signal, as the uptrend may be reversing.

- Island Bottom: Conversely, an Island Bottom forms when a downward gap first opens during a downtrend, followed by an upward gap. This signal indicates a reversal from a downtrend and is evaluated as a buy entry signal.

Reliability Factors

Island Reversal signals are considered highly reliable because they significantly impact market movements, but several factors influence their reliability.

- Time to Form: If an Island Reversal forms rapidly, the reversal momentum is considered strong. On the other hand, if it takes a long time to form, its reversal reliability may diminish.

- Number of Candlesticks: An island can sometimes be formed by a single candlestick, but if it consists of multiple candlesticks, the reliability of the signal increases. Especially when formed after a period of consolidation, the movement in the opposite direction is more likely to be stronger.

How to Utilize Buy/Sell Signals

The buy and sell signals using the Island Reversal are clear, and it is important to pay attention to the following points:

- Island Top: Recommended timing for a sell entry. After the first gap opens, a further upward gap suggests a reversal at the top.

- Island Bottom: Recommended situation for a buy entry. A newly opened gap allows for capturing the exact moment of a market bottom.

By deepening your understanding of these signals, you can more accurately grasp market judgments and entry opportunities, thereby helping to improve your trading success rate.

4. Trading During an Island Reversal

Identifying Entry Timing

When trading with an Island Reversal, identifying the entry timing is crucial. Generally, entries for Island Reversals follow these rules:

- For an Island Bottom : When the first gap opens after a market decline, prepare for a buy entry.

- For an Island Top : After the first gap opens following an ascent, prepare for a sell entry.

Confirming Buy/Sell Signals

When an Island Reversal forms, the key point to watch is the movement of the two gaps. Observe how the market moved after the first gap was confirmed. Refer to the points below:

- Kuangalia Uunganishaji: Ikiwa kipindi cha uunganishaji kinatathminiwa baada ya ufunguzi wa kwanza kufunguliwa, mabadiliko ya soko yanaweza kuwa na nguvu zaidi. Katika hatua hii, fikiria kurekebisha nafasi yako.

- Muda wa Ufunguzi wa Ufunguo wa Pili: Wakati ufunguzi wa pili unafunguliwa, mabadiliko ya mwelekeo wa soko yanaweza kukamilika kikamilifu. Ni bora kufanya kuingia mpya hapa na kujaribu kufunga nafasi za hasara zisizokamilika zilizopo.

Usimamizi wa Nafasi na Usimamizi wa Hatari

Usimamizi wa nafasi wakati wa kutumia Mabadiliko ya Juu la Juu ni muhimu sana kwa kupunguza hatari. Kumbuka vigezo vifuatavyo:

- Kuweka Uthibitisho wa Hatari: Weka wazi kiwango cha hatari yako na fahamu kiasi gani cha hasara unaweza kukubali ikiwa Mabadiliko ya Juu la Juu yatamalizika.

- Rekebisho la Nafasi kwa Mwelekeo: Wakati ufunguzi wa pili unafunguliwa, huenda usihitaji kufunga nafasi zote zilizofunguliwa, lakini kurekebisha ni muhimu ili kupunguza hatari.

Kuendeleza Mkakati wa Kuondoka

Kama kuingia, kuweka mkakati wa kutoka pia ni muhimu. Alama maalum ni kama ifuatavyo:

- Kwa Juu la Juu la Chini katika Mwelekeo wa Kuongezeka: Baada ya kuingia kwa ununuzi, fikiria kupata faida wakati soko linaanza kuinua tena. Kupata faida wakati ufunguzi wa pili unafunguliwa ni muhimu sana.

- Kwa Juu la Juu la Juu katika Mwelekeo wa Kupungua: Baada ya kuingia kwa kuuza, ikiwa soko linaanza kubadilika, kufunga nafasi mapema kunaweza kupunguza hasara.

Kwa hiyo, biashara kwa kutumia Mabadiliko ya Juu la Juu inahitaji njia ilio na ufanisi kwa muda wa kuingia, usimamizi wa nafasi, na mkakati wa kutoka. Kwa kuelewa kila kipengele na kuichukua katika mazoezi, unaweza kupata biashara bora zaidi.

5. Jinsi ya Kutambua Alama za Mabadiliko ya Juu la Juu za Kushindwa (Mifumo)

Mabadiliko ya Juu la Juu ni muundo wa kitekniki unaoheshimika sana kwa wauzaji wengi, lakini kuamini bila kuangalia yanaweza kuleta hatari. Khasusi, kuna uwezekano wa alama za upendeleo (mifumo), hivyo ni muhimu kuyatambua. Hapa ni vigezo muhimu vya kutambua alama za upendeleo:

1. Ukubwa wa Ufunguo wa Pili

Ukubwa wa ufunguo wa pili, kipengele cha kawaida cha Mabadiliko ya Juu la Juu, ni kipimo muhimu cha uaminifu wa alama. Ukubwa zaidi wa ufunguo, nguvu zaidi ya soko ya kuuliza, na uwezekano zaidi wa mabadiliko. Kwa upande mwingine, ikiwa ufunguo ni mdogo, mara nyingi unaweza kulipimwa kwa urahisi, kuongeza uwezekano wa mwelekeo kuendelea.

2. Kuonekana kwa Mifumo Mikubwa ya Bullish au Bearish

Ikiwa mifumo imara ya bullish (陽線) au bearish (陰線) inatokea baada ya Mabadiliko ya Juu la Juu kutokea, uaminifu wa alama unazidi. Mabadiliko haya ya kuelekea wazi yanaonyesha kwamba tabia ya mteja inathibitishwa kwa nguvu katika mwelekeo tofauti, kupunguza hatari ya alama za upendeleo.

3. Uthibitisho kwa Mifumo nyingi

Wakati Mabadiliko ya Juu la Juu yanatokana na mifumo mingi badala ya moja, alama inahesabiwa kuwa imara zaidi. Uumbaji wa kudumu unaonyesha nia za wauzaji wengi, kuongeza shinikizo wakati wa mabadiliko. Hata hivyo, pia ni muhimu kuzingatia athari za habari au matukio ya haraka.

4. Umuhimu wa Muda uliopita

Muda unachochukua Mabadiliko ya Juu la Juu kutokea pia unathiri uaminifu wa alama. Uumbaji wa haraka unahesabiwa kuwa alama imara, lakini ikiwa unachukua muda mrefu kutokea, uaminifu wake unaweza kupungua. Kwa hiyo, ni muhimu kuchambua pia kwa mtazamo wa muda.

5. Ufuatiliaji wa Idadi ya Biashara

Idadi ya biashara wakati wa Mabadiliko ya Juu la Juu pia ni kipimo muhimu cha kutambua alama za upendeleo. Wakati idadi ya biashara ni kubwa, harakati mara nyingi ni za kuaminika, lakini kwa upande mwingine, idadi ndogo ya biashara inakuongeza hatari ya alama za upendeleo. Ni muhimu kuwa na ujuzi juu ya mwenendo wa idadi ya biashara na kuhakikisha usimamizi wa hatari mzuri.

Kwa kutathmini Mabadiliko ya Juu la Juu kwa vigezo hivi, unaweza kuepuka alama za upendeleo na kufanya biashara yenye maana zaidi. Weka viwango vya uamuzi wako kwa imani na uangalie njia yako kwa soko.

Muhtasari

The Island Reversal is an important technical indicator of market reversals, but careful analysis is required to enhance its reliability. It’s crucial to comprehensively consider factors like candlestick shape, changes in trading volume, and time elapsed to identify the possibility of false signals. Additionally, by properly setting entry, position management, and exit strategies, you can effectively utilize the Island Reversal. Traders who deepen their knowledge and incorporate this into their trading methods should achieve more stable returns.

Frequently Asked Questions

What is the distinctive shape of an Island Reversal?

An Island Reversal is formed by two accompanying gaps. The first gap opens during an ongoing trend, causing the market price to rapidly increase or decrease. Subsequently, the price reverses, and by opening another gap in the opposite direction, it returns to the original price range, creating an “isolated island” shape on the chart.

How does the Island Reversal formation process proceed?

First, an upward gap opens in an uptrend, followed by the formation of an isolated island near the highest point. Then, prices fall sharply, and a downward gap opens. At this stage, investors holding unrealized losses begin to feel psychological pressure and choose to sell, accelerating the market reversal. Finally, the Island Reversal completes, indicating a transition from an uptrend to a downtrend.

Island Reversals have two patterns: “Island Top” and “Island Bottom.” What are their respective characteristics?

An Island Top forms when an upward gap first opens during an uptrend, immediately followed by a downward gap. This is considered a sell signal. Conversely, an Island Bottom forms when a downward gap first opens during a downtrend, followed by an upward gap. This signal is evaluated as a buy entry signal.

What are the key points for identifying false Island Reversal signals (traps)?

Key points for identifying false Island Reversal signals include the size of the second gap, the occurrence of large bullish or bearish candlesticks, confirmation by multiple candlesticks, the time it takes to form, and trading volume trends. By comprehensively judging these factors, you can identify highly reliable signals.